Search This Blog

Sunday, June 1, 2025

Cullinan, Taiho Pivotal REZILIENT1 Phase 1 2 Data Published

Fed's Waller still open to cutting interest rates later this year

Federal Reserve Governor Christopher Waller said on Monday that interest rate cuts remain possible later this year even as the Trump administration’s tariff regime is likely to push up price pressures temporarily.

Given that a rise in inflation pressures tied to President Donald Trump’s import tax increases is likely not to last, “I support looking through any tariff effects on near term-inflation when setting the policy rate,” Waller said in the text of a speech prepared for delivery before a gathering in Seoul, South Korea.

If tariffs settle in the lower end of the range of possibilities and “underlying inflation continues to make progress to our 2% goal” with a still “solid” job sector, “I would be supporting ‘good news’ rate cuts later this year,” Waller said.

He added, “Fortunately, the strong labor market and progress on inflation through April gives me additional time to see how trade negotiations play out and the economy evolves” before needing to decide what the central bank should so with interest rates.

Waller’s comments on the outlook for the economy and monetary policy hew close to his recent comments and come amid considerable uncertainty about the president’s trade policy.

Trump has made large and unpredictable shifts in tariff rates as well as their timing. At the same time, the tariff system is facing legal challenges that could ultimately blunt the entire endeavor.

Economists and Fed officials generally believe the tariffs will push up unemployment and inflation while slowing growth. The tax increases have also called into question whether the central bank will be able to deliver any cuts to what is now a federal funds target rate range of between 4.25% and 4.5% this year.

Waller’s openness to cutting interest rates later this year if economic conditions allow it contrasts with other central bankers, who have taken a cautious wait-and-see attitude.

The economy has thus far seen very little impact from tariffs, but that could change, Waller said.

“I see downside risks to economic activity and employment and upside risks to inflation in the second half of 2025, but how these risks evolve is strongly tied to how trade policy evolves,” Waller said.

“Higher tariffs will reduce spending, and businesses will respond, in part, by reducing production and payrolls,” he said.

The Fed official said that, while tariffs will be the main driver of inflation, they are likely to be one-time increases “most apparent in the second half of 2025.” In the case of more modest duties in the range of 10%, some portion of the rise will not be fully passed through to consumers.

The Fed official also said the risks of a "large" tariff scenario imposed have gone down.

Waller also flagged what have been divergent readings on inflation expectations. He said he more closely watches market views and those of professional forecasters, both of which expect price pressures to remain contained, than surveys. Waller noted real world data is also not showing much deterioration in the expected path of inflation.

ASCO 25: Regeneron hails Libtayo's adjuvant data in CSCC

Regeneron's PD-1 inhibitor Libtayo could find wider use for a form of skin cancer known as cutaneous squamous cell carcinoma after showing efficacy in a pivotal trial as adjuvant therapy for patients who have had surgery to remove their tumour.

New data from the 415-subject C-POST study presented at ASCO and published in the New England Journal of Medicine shows that the immunotherapy achieved a 68% reduction compared to placebo in the risk of disease recurrence or death, when given after surgery and radiotherapy for CSCC.

The results – which have already been submitted to regulators in the US and EU – also revealed an 80% fall in the risk of localised recurrence of the tumour and a 65% reduction in recurrence at distant sites in the body after two years of follow-up.

Libtayo (cemiplimab) was cleared in 2018 for treating advanced CSCC in patients who are not candidates for curative surgery and/or radiation, subsequently picking up additional FDA approvals in basal cell carcinoma, another form of skin cancer, and non-small cell lung cancer (NSCLC).

The immunotherapy breached the blockbuster sales threshold last year, growing 41% to $1.22 billion.

If approved, the adjuvant CSCC indication could lend further sales momentum to the drug, particularly as MSD's rival PD-1 inhibitor – market-leading Keytruda (pembrolizumab) – failed in this indication in the KEYNOTE-630 study which is also being presented at ASCO.

There is a larger addressable patient population in the adjuvant setting compared to the advanced disease setting, where Libtayo is already considered the standard of care.

Niche free of Keytruda competition

The new data breaks new ground for the PD-1/PD-L1 inhibitor class in CSCC, although – like Libtayo – Keytruda is approved as an option for patients ineligible for surgery, as is Checkpoint Therapeutics' Unloxcyt (cosibelimab), which was cleared by the FDA for this indication in December. Checkpoint is in the process of being taken over by Sun Pharma.

According to the new data, 87% of Libtayo-treated patients remained disease-free at two years, compared to 64% of those on placebo. There were trends favouring the PD-1 inhibitor on overall survival, coming in at 94.8% at the two-year mark versus 92.3% for placebo, which Regeneron said pointed to an "emerging benefit" with the drug.

"While surgery and radiotherapy remain the cornerstones of treatment for high-risk [CSCC], there is a critical unmet need for systemic therapies to help prevent relapse and metastasis to ultimately drive better outcomes for patients," said C-POST lead investigator Danny Rischin of the Peter MacCallum Cancer Centre in Melbourne, Australia.

The positive readout is a welcome boost for Regeneron, which saw its shares slide last week after it reported mixed clinical data from phase 3 trials of its Sanofi-partnered IL-33 inhibitor itepekimab in chronic obstructive pulmonary disease.

https://pharmaphorum.com/news/asco-25-regeneron-hails-libtayos-adjuvant-data-cscc

Trump Admin Shuts Down Massive $66 Million Food Stamp Fraud Scheme

A U.S. Department of Agriculture (USDA) employee and five others have been arrested for allegedly defrauding the Supplemental Nutrition Assistance Program (SNAP) of more than $66 million in unauthorized transactions, according to Fox Business.

Secretary of Agriculture Brooke Rollins called it “one of the largest stings” in USDA history, emphasizing, “At USDA, we are hyper-focused… on rooting out that waste, fraud and abuse.” She added, “This is a new day, and President Trump promised... that it would not be the government that we know.”

The defendants — Michael Kehoe, Mohamad Nawafleh, Omar Alrawashdeh, Gamal Obaid, Emad Alrawashdeh, and USDA employee Arlasa Davis — face charges of “conspiracy to steal government funds and to misappropriate U.S. Department of Agriculture benefits,” according to prosecutors.

Fox Business News writes that the scheme, which began in 2019, allegedly involved Kehoe supplying 160 unauthorized electronic benefit transfer (EBT) cards to stores across the New York area, enabling over $30 million in fraudulent transactions. Prosecutors say Davis sold confidential information to criminals, undermining a program that “vulnerable New Yorkers depend on for basic nutrition,” U.S. Attorney Perry Carbone said.

“These charges should be a reminder that those who exploit anti-poverty programs for personal gain will be held accountable for their crimes,” Carbone added.

According to officials, the group also submitted fraudulent USDA applications, misappropriated license numbers, and doctored documents to benefit unauthorized stores.

Rollins vowed ongoing action: “That is no longer going to be allowed here in Washington,” she said. “This is not the ‘one and only.’ There are going to be many more to come… We're going to make sure that we're delivering on our promises to the taxpayers.” She concluded, “It’s just the tip of the spear... There’s going to be real consequences for breaking the law.”

https://www.zerohedge.com/markets/trump-admin-shuts-down-massive-66-million-food-stamp-fraud-scheme

Should Primary Care Be Covered by Insurance?

- David A. Hyman MD, JD,

- Brian Uhlig BBA &

- Ge Bai PhD, CPA

Primary care accounts for 30% of the physician workforce, and more than half of all office visits.1 Access to primary care results in better health outcomes and lower total health spending.2 Despite multiple efforts to promote primary care, only 9% of medical school graduates match with a family medicine residency and less than 20% of internal medicine residency graduates pursue a career in primary care.1 These figures are well below the level needed to replace retiring primary care physicians. Primary pediatric care is subject to similar challenges.

These dismal figures should not be a surprise. Primary care physicians earn 30% less than other physicians and have the highest rate of burnout among doctors. Dealing with multiple insurance companies and the varying electronic health records requirements for referrals means that primary care physicians face a high “hassle factor.” Emotional challenges also arise from the distinct characteristics of primary care.3 Meanwhile, one in five Americans lives in a federally designated primary care health professional shortage area, and average wait times for new appointments are increasing. The combination of growing patient demand, dwindling physician supply, and high physician burnout makes it clear that changes must be made.

Various reform proposals have been floated for primary care, such as increasing Medicare payment rates and establishing a spending target.1,2,4 In this Viewpoint, we argue that eliminating insurance coverage of primary care holds the key to improving primary care practice, patient health outcomes, and physician well-being.

This approach will sound counterintuitive to most readers, but eliminating insurance coverage could improve primary care and health outcomes. First, insurance creates value by pooling risk (i.e., by shifting, spreading, and diversifying risk). However, inexpensive and frequent expenditures are typically not insurable because the administrative cost of processing these claims outweighs the benefits of pooling the associated risks.5 Primary care is both predictable and relatively inexpensive, so using insurance to pay for is likely to lead to welfare losses for patients and plan sponsors.5,6 The cost of paying for primary care through insurance is non-trivial: insurance generates substantial administrative expenses for processing, adjudicating, and paying each individual claim. Insurance also creates a significant “hassle factor” for primary care physicians who must deal with multiple companies, wasting money, time, and staff hours entering data, managing network contracts, and the like.

Second, hospitals use primary care as a gateway to lock in referrals and capture patients and revenue within their hospital-owned systems. Patients are less likely to leave a health care system that owns both their primary care and referral services. Hospitals, insurance companies, pharmacy chains, and private equity firms all have an incentive to acquire primary care practices to retain referral services within their own networks, and capture the profit margins generated by referred services. Once insurance coverage is off the table, many of these arrangements will be unwound. Independent physician practices will gain greater autonomy, fostering competition and expanding patient choice.

Third, although the direct-pay market is small, cash prices are routinely lower than insurer-negotiated prices.5,6,7 Because insurance companies must be paid to adjudicate claims, removing primary care from insurance could actually benefit patients financially. More importantly, price-sensitive patients directly benefit from lower prices. This price sensitivity, which has driven down prices for healthcare products and services not covered by insurance, could do the same for primary care.5

To address these issues, policymakers should allow plan sponsors to offer beneficiaries the option of catastrophic coverage that excludes primary care and other low-cost routine services and products.5 Preventive services could remain covered pre-deductible, while catastrophic coverage will offer protection from major expenses—the actual core function of insurance. To protect patients who choose this option and are seriously ill or financially disadvantaged, policymakers should broaden Health Savings Accounts (HSAs) eligibility and allow HSAs to receive government subsidies and tax-deductible contributions from employers, organizations, or other individuals. The scope of HSAs should also be broadened to include many of the social determinants of health.6

Once insurance is removed from the equation, beneficiaries could select any primary care provider they want without any insurer-imposed network restrictions. They could pay standardized cash prices and benefit from the triple tax advantages of HSAs (i.e., tax-deductible contributions, tax-free investment growth, and tax-free withdrawals). This system could promote price competition, reduce premiums, and expand access to primary care. Competition could motivate physicians to both deliver quality primary care and coordinate necessary special care to satisfy patients and retain their business. Market diversification could cater to patients’ varied tastes and preferences (e.g., “Whole Foods vs Walmart”), delivering value to patients and benefiting physicians.

Additionally, this reform could lessen paperwork burdens, simplify administrative complexities, and alleviate the burnout currently associated with primary care practice. These changes could make primary care more appealing to residents and medical students, helping to address the shortage of primary care physicians. Removing primary care from insurance will also significantly reduce the number of claims that insurers need to process, allowing them to focus on higher-cost and less-frequent procedures and expenses.

Excluding primary care from insurance also has the potential to open the door to patient-focused innovation, such as care models that incorporate non-traditional aspects of clinical care (e.g., dietitians and mental health counselors) and “virtual appointment first, in-office second” models for same-day care. Primary care physicians might also partner with independent pharmacists or mail-order pharmacies to deliver common generic drugs to patients’ homes via monthly subscription or on-demand payment. Competing primary care models (i.e., independent vs. system-affiliated) could coexist in the market, alleviating market consolidation and improving patient welfare.

Patients could benefit from a broader choice of providers competing to meet their needs, leading to better health outcomes. These advantages are especially important for Medicaid and underinsured low-income patients. Despite decades of policy efforts, physician participation in Medicaid remains low, primarily owing to the program’s low payment rates and high administrative burdens. As a result, beneficiaries are often forced to obtain outpatient care from hospitals. This is clinically suboptimal for patients and financially inefficient for taxpayers. Our proposal directly subsidizes HSAs, putting Medicaid beneficiaries on an equal footing with non-Medicaid patients. By making Medicaid beneficiaries more appealing to primary care physicians, this approach could address access disparities and improve health outcomes. For underinsured low-income patients, HSA subsidies could directly support their out-of-pocket needs and mitigate their risk exposure to medical debt.

Primary care is a vital vehicle to improve health and identify and treat conditions earlier, less intensively, and less expensively. Certain existing regulations make primary care a fixture of insurance coverage. However, previous reforms have not delivered the hoped for outcomes. It is long past time to recognize the detrimental effects of insurance on primary care. We should take steps to allow primary care physicians to decide how to best serve their patients. Removing insurance from the equation could relieve administrative burdens, promote physician well-being, stimulate patient-centered innovation in care delivery, expand patient access to primary care, and improve population health.

https://link.springer.com/article/10.1007/s11606-025-09541-3

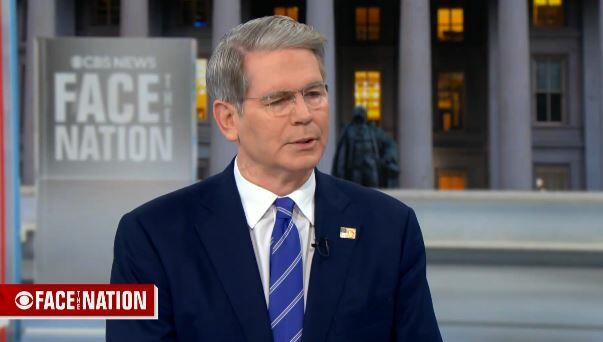

"Everything Alarmist": Bessent Shuts Down CBS On Inflation, Says US Will 'Never Default' On Debt

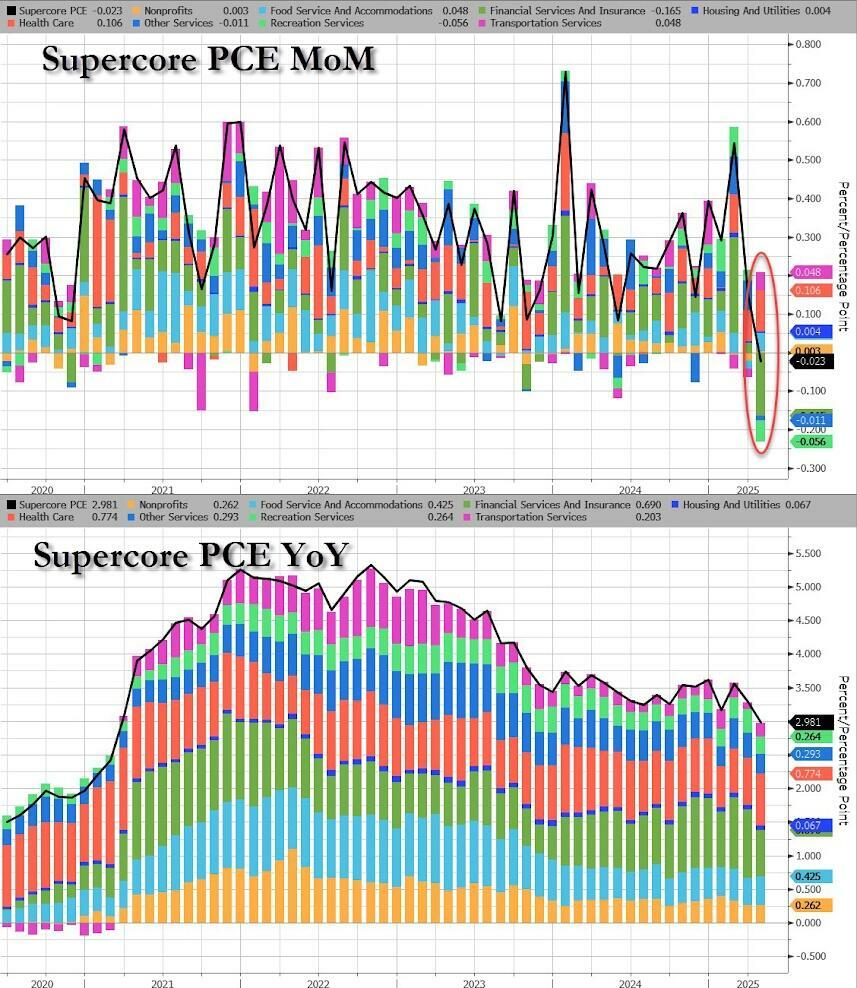

For months, all we've heard from mainstream economic pundits is that Trump's tariff scheme would lead to absolute chaos; ports would be shut down, inflation would cripple the US economy, and markets would crater. The response was an April rollercoaster in stocks that ended the month higher, while the most recent inflation metrics had core PCE (personal consumption expenditures) coming in at its lowest level in years, while 'supercore' inflation (service-based inflation) dropped the most since COVID. So, just the opposite of what we were told would happen.

On Sunday, Treasury Secretary Scott Bessent disintegrated the conventional wisdom, while raking CBS News' Margaret Brennan over the coals in response to the media's fake news hysteria.

The key excerpts from the interview:

BESSENT: "Thus far there have been no price increases - everything has been alarmist. The inflation numbers are actually dropping. We saw the first drop of inflation in four years. The inflation numbers last week, they were very pro-consumer."

BRENNAN: "But you listen to earnings calls just like we do. You know what Walmart is saying, what Best Buy is saying, and what Target is saying."

BESSENT: "But Margaret, I also know what Home Depot and Amazon are saying. I know what the South China Morning Post wrote within the past 24 hours - that 65% of the tariffs will likely be eaten by the Chinese producers."

BRENNAN: "The reality is there will either be less inventory, or things will be at higher prices, or both."

BESSENT: "Margaret, when we were here in March, you said there was going to be big inflation. There hasn't been any inflation. Actually, the inflation numbers were the best in four years. So why don't we stop trying to say 'this could happen,' wait and see what does happen.

Bessent also pushed back on a warning by JPMorgan Chase CEO Jamie Dimon, who said that a crack in the bond market "is going to happen."

"I’ve known Jamie a long time, and for his entire career he’s made predictions like this," said Bessent. "Fortunately none of them have come true. That’s why he’s a great banker. He tries to look around the corner."

Bessent also insisted that the US "is never going to default," as the deadline for raising the debt ceiling yet again approaches.

"That is never going to happen," he told Brennan, adding "We are on the warning track and we will never hit the wall."

Bessent's comments come as the US Senate returns this week to take up President Donald Trump's 'Big Beautiful Bill,' which includes an increase in the debt limit before the so-called "X-date" when the Treasury runs out of cash and special accounting measures that would allow it to operate it within the debt ceiling and still meet federal obligations on time.

"We don’t give out the ‘X date’ because we use that to move the bill forward," Bessent said (yet, he told lawmakers last month that the US was likely to exhaust its ability to borrow by August if the debt ceiling isn't raised or suspended by then.

Last week the Trump administration lashed out at Beijing for what they said was a violation of a US-Chinese tariff truce reached in May. Today, Bessent said he's confident that this "will be ironed out" in a call between Trump and Chinese president Xi Jinping "very soon."

According to White House National Economic Council Director Kevin Hassett, the call is expected to take place this week - telling ABC's This Week that Trump "is going to have a wonderful conversation about the trade negotiations this week with President Xi."

On Friday, US Trade Rep. Jamieson Greer accused Beijing of failing to comply with several elements of the trade agreement brokered in Geneva, insisting that China continues to "slow down and choke off things like critical minerals and rare-earth magnets."

Bessent addressed this on Sunday, saying "Maybe it’s a glitch in the Chinese system, maybe it’s intentional," adding "We’ll see after the president speaks with the party chairman."

14 People Charged In $25 Million COVID Relief, Small Business Loan Fraud Scheme

by Aldgra Fredly via The Epoch Times (emphasis ours),

Fourteen people were arrested on May 28 for allegedly being involved in a scheme to fraudulently obtain over $25 million in COVID-19 relief funds and federally guaranteed small business loans, according to the Department of Justice (DOJ).

The individuals are among the 18 people charged in connection with the case. Four who have not yet been arrested are currently believed to be in Armenia, the DOJ said in a statement.

All of them are facing charges of conspiracy to defraud the government, false claims, wire fraud, bank fraud, money laundering, laundering of monetary instruments, monetary transactions involving property derived from specified unlawful activity, and structuring financial transactions to evade reporting requirements.

Law enforcement officers seized about $20,000 in cash, two money-counting machines, paper cash bands, cellphones, laptops, two loaded semi-automatic handguns, and boxes of ammunition during the arrests.

Tyler Hatcher, special agent in charge of IRS Criminal Investigation, said the defendants were accused of fraudulently obtaining funds through the Small Business Administration’s (SBA) Paycheck Protection Program, Economic Injury Disaster Loan program, and other federal funding programs.

“These programs were established to assist individuals and businesses in need of financial assistance and instead were pilfered by the named defendants,” Hatcher said in the statement.

Among those arrested was Vahe Margaryan, 42, who allegedly instructed “owners of sham companies” to open bank accounts and fabricate documents to support loan applications used to purchase other fake businesses.

Prosecutors alleged that Margaryan orchestrated the scheme from 2018 to January 2025 and paid for tax returns that falsely claimed millions in revenue and tens of thousands in taxes owed.

Another defendant named by the DOJ is 77-year-old Felix Parker, who was arrested for allegedly making false statements and providing fraudulent documents, including fake tax returns, in January 2023.

Parker is believed to have received more than $2 million through a government-backed small business program, the DOJ stated.

Also arrested was 47-year-old Axsel Markaryan, who was accused of submitting fake documents to fraudulently secure more than $5 million in SBA loans in June 2023.

Prosecutors stated that Markaryan allegedly transferred at least $100,000 to a co-conspirator in Armenia just months after obtaining the loans.

Authorities also arrested Sarkis Gareginovich Sarkisyan, 37, who allegedly submitted a false application and false documents to obtain a loan through the Paycheck Protection Program, which provides low-interest, forgivable loans to help small businesses retain their staff and cover expenses during the pandemic. Sarkisyan allegedly received more than $700,000 from the program by creating a fake business.

“This transnational criminal network sought to defraud the government of millions of dollars and almost succeeded,” Homeland Security Investigations (HSI) Los Angeles acting special agent in charge John Pasciucco stated.

It remains unclear whether the defendants have been assigned legal representation as of publication.