In Sep. 29 trading session, CTI BioPharma (CTIC +87.6%) trading was halted pending news; currently stock has surged 88% in a single day trading.

Maintaining its Outperform and Buy rating, JMP Securities (to $4 from $3) and Needham (to $6 from $3.50), respectively, raised price targets on CTI BioPharma.

JMP analyst Reni Benjamin and Needham analyst Chad Messer note that CTI Biopharma announced that the FDA agreed to an accelerated approval pathway for pacritinib in myelofibrosis patients with severe thrombocytopenia, and said it expects to complete a rolling NDA submission by Q1 2021.

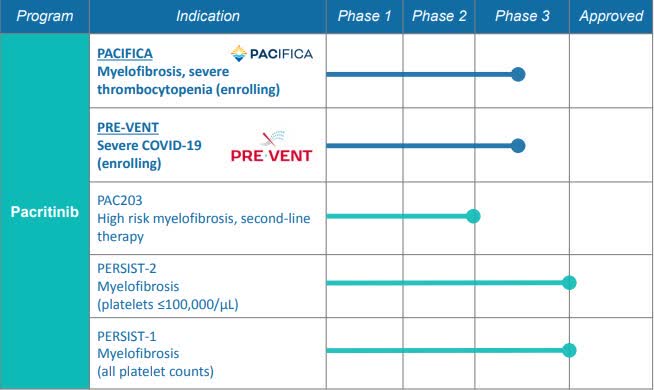

More than 1.2K patients have been dosed with pacritinib. Quick look at it's development program:

With a rolling NDA for pacritinib in MF patients with severe thrombocytopenia expected to complete submission in Q1 2021; an ongoing study in hospitalized patients with COVID-19; an IST with results expected in Q4 for GvHD, and a cash position of $61M, Benjamin continues to recommend CTIC.

As per the company's latest investor presentation, top-line primary analysis data is expected in 2022.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.