Today’s blockbuster GDP report should serve as a strong reminder that this year’s biggest present to the American people came back in July when President Trump and Republicans in Congress passed the Big Beautiful Tax Bill. Every single House and Senate Democrat voted repeatedly to let all of the Trump tax cuts expire, which would have raised taxes on the middle class by about $1,500 per household next year.

Gee, snatching more money out of worker paychecks would have helped with the “affordability crisis.”

Here are some of the tax hikes that would have been arriving on January 1 if they got their way:

- The standard deduction would have been cut in half, raising taxes and forcing millions of taxpayers to itemize.

- Tax rates would have spiked, with every rate rising and the top rate jumping from 37% to 39.6%.

- Unlimited SALT deductions would have come back, a huge giveaway to the wealthy in high-tax states.

- The Child Tax Credit would have been slashed from $2,000 to $1,000.

- Small business taxes would have soared from 29.6% to 39.6%.

- The AMT and death tax would have snapped back to pre-2017 exemption levels, ensnaring millions of families.

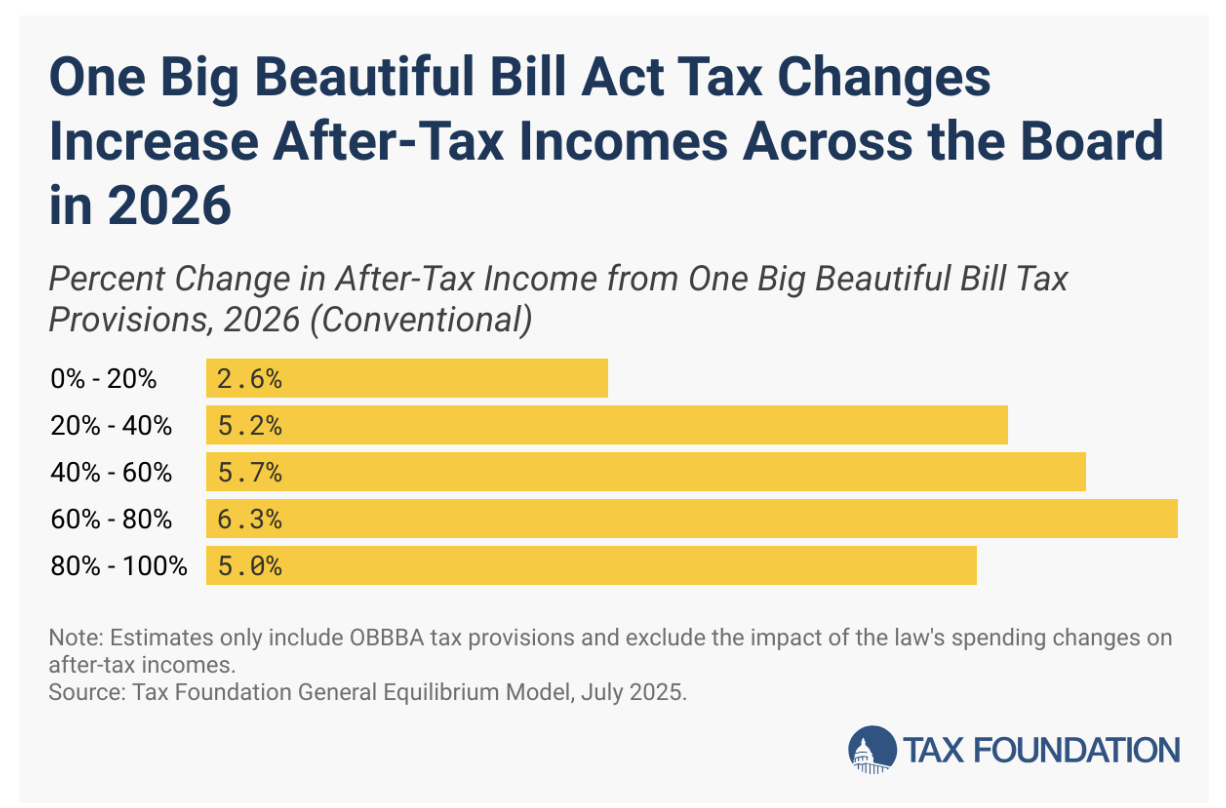

The Tax Foundation shows that all income-groups benefited:

Everyone got a tax cut. And the Left wanted everyone to get a tax hike.

https://committeetounleashprosperity.com/hotlines/christmas-came-in-july/

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.