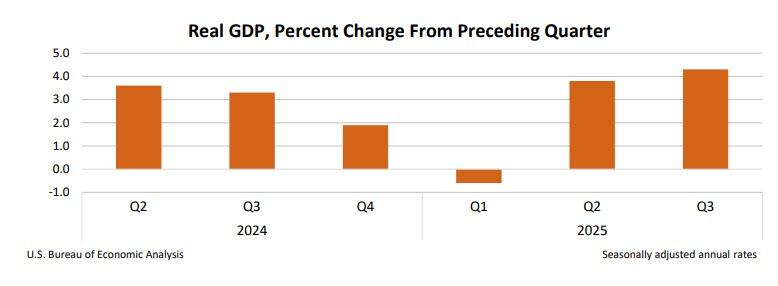

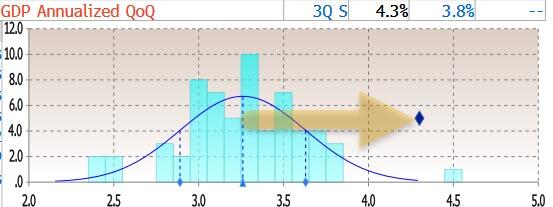

By now, Q3 GDP - which should have been reported almost two months ago - is ancient history but it still matters in a world where the Fed's every sneeze is overanalyzed. Which is why the report by the Bureau of Economic Analysis that in Q3 US GDP surged by 4.3%, up from an already hot 3.8% in Q2 and driven by a spike in consumer spending, will surely raise some eyebrows (for those wondering, this report was originally supposed to hit on Oct 30, and the second estimate was scheduled for Nov 26; none of that happened due to the govt shutdown). This was the highest annualized quarterly GDP print since Q3 2023.

The number was higher than all but one economist forecasts, and was a 3-sigma beat to the median consensus of 3.3%

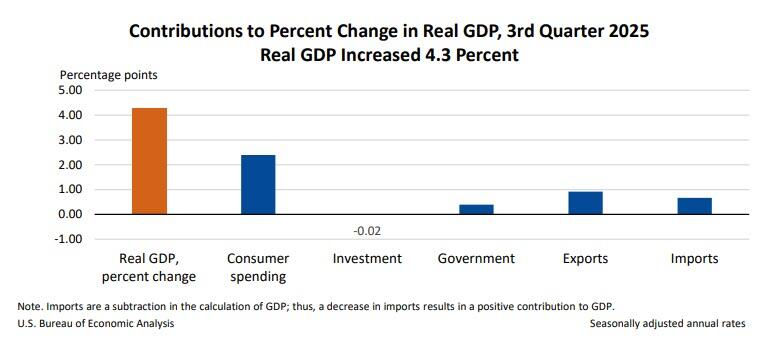

According to the BEA, the increase in real GDP in the third quarter reflected increases in consumer spending, exports, and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Compared to the second quarter, the acceleration in real GDP in the third quarter reflected a smaller decrease in investment, an acceleration in consumer spending, and upturns in exports and government spending. Imports decreased less in the third quarter.

Taking a closer look at the components, this is how the 4.34% increase in bottom line GDP happened:

- Personal Consumption rose by a whopping 2.39%, up from 1.68% in Q2

- Fixed Investment moderated, rising by 0.19%, vs 0.77% in Q2. Once again, this is mostly data centers

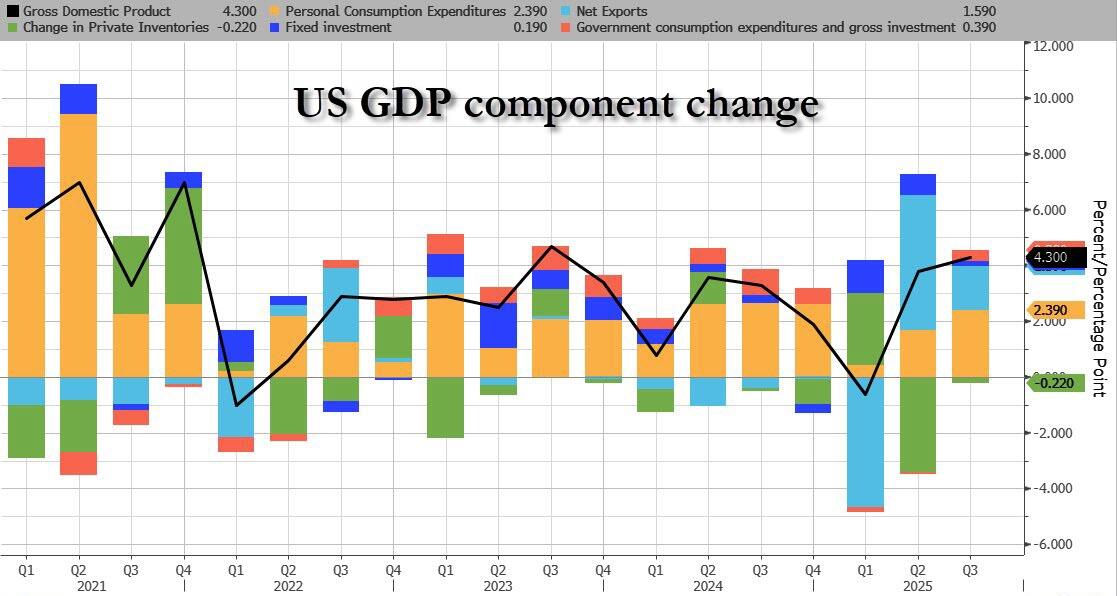

- Change in private inventories declined by 0.22%, a moderation from the -3.44% drop in Q2, and to be expected as the trade aberration from the trade war moderate

- Net trade (exports less imports) also normalized and after a surge of 4.83%, the increase was a more modest 1.59%, driven by positive contributions from both exports (0.67%) and imports (0.92%).

- Finally, government contributed 0.39% to Q3 GDP after subtracting from US growth in each of the previous two quarters of 2024.

And visually:

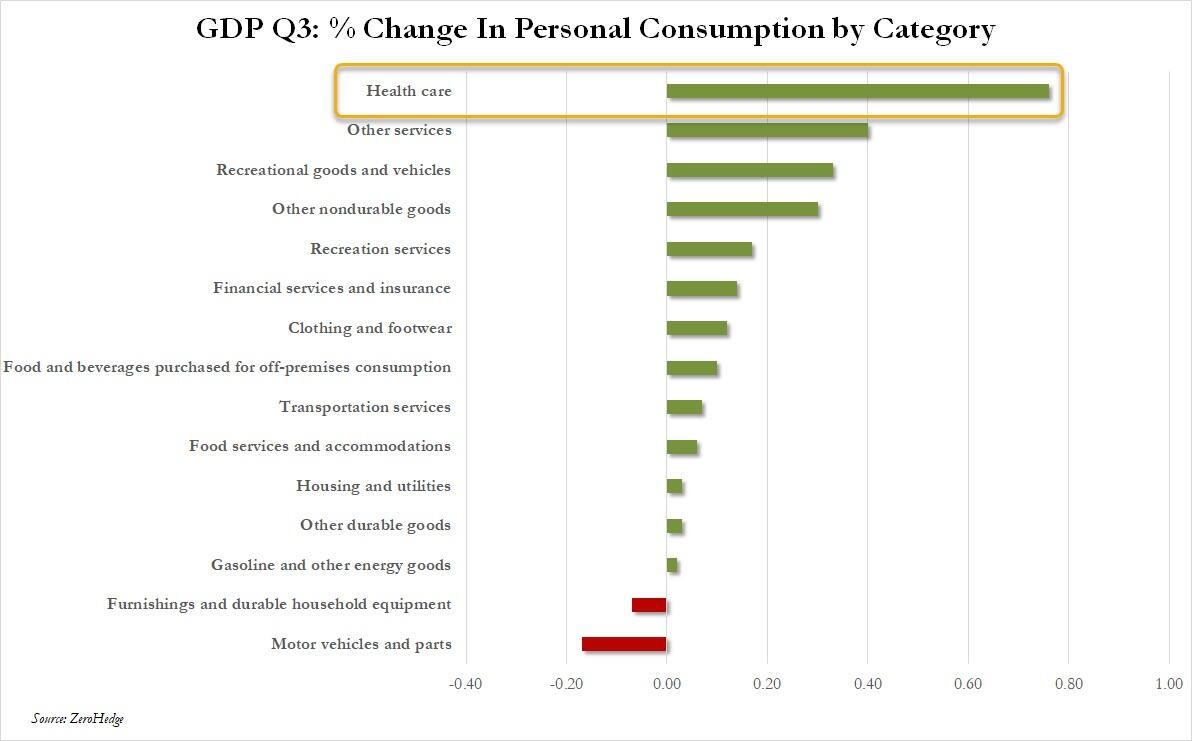

While the surge in personal consumption would be a red flag for the Fed, as it indicates the US consumer is much stronger than expected, the reality is that - as shown below - the bulk of the increase was the result of surge in healthcare spending, which increased at a whopping 0.76% adjusted annual rate. Which means that personal spending was not driven by discretionary splurging but by a need to meet much higher health insurance costs!

Linked to this surge in health insurance, the GDP price index for Q3 jumped 3.8%, up from 2.1% in Q2 and a big beat to the 2.7% estimate. The personal consumption expenditures (PCE) price index increased 2.8%, compared with an increase of 2.1%. Excluding food and energy prices, the PCE price index increased 2.9 percent, in line with estimates, and higher than the increase of 2.6 percent in Q2.

Overall, this was a stronger than expected print however for all the wrong reasons. As to whether it will change the Fed's thinking, we very much doubt it if the US labor market continues deteriorating as it has been for much of 2025.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.