Amarin (NASDAQ:AMRN) is down 10% premarket on robust volume in apparent reaction to reports that judges have been assigned in its appeal of an adverse ruling by a Nevada court opening the gate for generic versions of Vascepa (icosapent ethyl).

On March 30, shares plummeted after the district court ruled that certain of the company’s patents are invalid, unenforceable and/or will not infringed by generic versions described in the marketing applications filed by Dr. Reddy’s Laboratories (NYSE:RDY) and Hikma Pharmaceuticals USA (10-Q, page 43).

Vascepa accounted for 99% of the company’s Q2 revenue ($133.7M/135.2M).

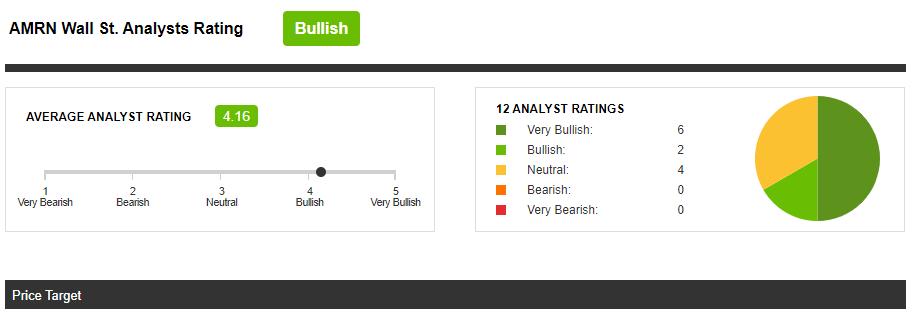

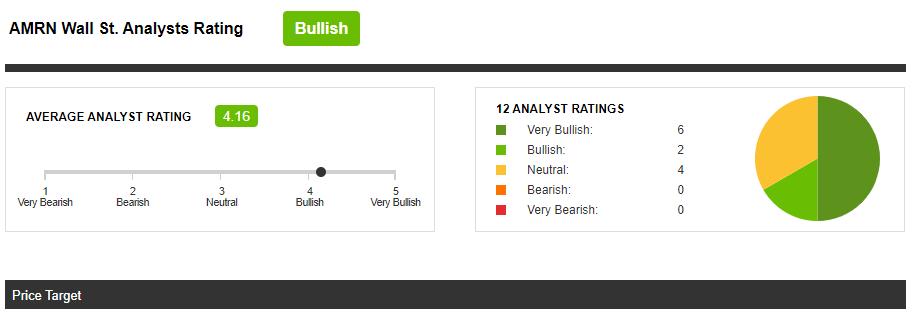

Despite the risk of an unsuccessful appeal, Wall Street sell-siders are Bullish on the stock with a consensus fair value target of $13.80 (90% upside). The situation is a classic binary event that characterizes biopharma/biotech stocks. According to analysts, a win could propel shares to $30 – 35 while a loss could send prices reeling to the $2 – 4 range.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.