Search This Blog

Thursday, May 2, 2019

Endologix earnings call brighter but risks remain, says Piper Jaffray

Piper Jaffray analyst Matt O’Brien kept his Neutral rating and $10 price target on Endologix after its in-line Q1 results. The analyst says investors should monitor signs of “stabilization” in the company’s U.S. business amid continued operational risks this year along with its cash burn, adding that the tone of Endologix earnings call was “brighter” but also conservative.

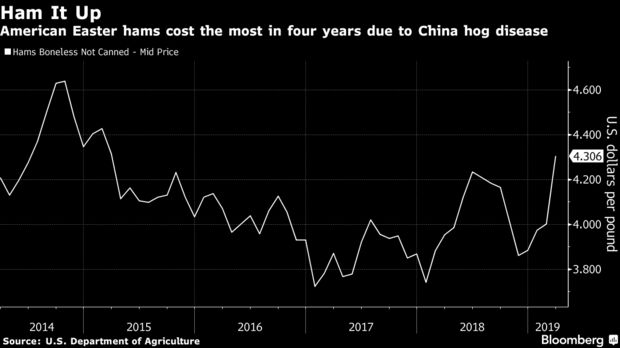

Pig ‘Ebola’ Virus Sends Shock Waves Through Global Food Chain

What started with a few dozen dead pigs in northeastern China is sending shock waves through the global food chain.

Last August, a farm with fewer than 400 hogs on the outskirts of Shenyang was found to harbor African swine fever, the first ever occurrence of the contagious viral disease in the country with half the world’s pigs. Forty-seven head had died, triggering emergency measures including mass culling and a blockade to stop the transportation of livestock. Within days, a government notice proclaimed the outbreak “effectively controlled.”

It was too late. By then, the disease had literally gone viral, dispersed across hundreds of miles in sickened animals, contaminated food, and in dirt and dust on truck tires and clothing. Nine months later, the contagion has spread nationwide, crossed borders to Mongolia, Vietnam and Cambodia, and bolstered meat markets globally.

While official estimates count 1 million culled hogs, slaughter data suggest 100 times more will be removed from China’s 440 million-strong swine herd in 2019, the Chinese zodiac’s “year of the pig.” The U.S. Department of Agriculture forecast in April a decline of 134 million head — equivalent to the entire annual output of American pigs — and the worst slump since the department began counting China’s pigs in the mid 1970s.

Pig Out

China’s hog output is predicted to slide 20% in 2019 to a 17-year low.

“This is an unprecedented situation,” said Arlan Suderman, chief economist for INTL FCStone Inc., who has been analyzing commodity markets for almost four decades. “This will impact food prices globally.”

Like Ebola

The strain of African swine fever spreading in Asia is undeniably nasty, killing virtually every pig it infects by a hemorrhagic illness reminiscent of Ebola in humans. It’s not known to sicken people, however.

The harm to pigs is especially critical for China, with a $128 billion pork industry and the world’s third-highest per-capita consumption.

Pork Lovers

China’s 2017 per-capita pork consumption was almost triple the global average.

China’s hog herd may decline as much as 30 percent, said Juan R. Luciano, chief executive officer of Archer-Daniels-Midland Co., one of the biggest agricultural commodity traders.

“China will clearly need to import substantial amounts of pork and likely other meat and poultry to satisfy demand,” Luciano told analysts on an April 26 conference call. Chinese meat purchases may also boost sales of soybean meal, a source of livestock feed, in North America, Brazil, and Europe, he said.

Wholesale pork prices in China are already 19 percent higher than a year ago, and have risen in the U.S. and EU after processors sent more of their product to China. The price of bacon in Spain jumped about 20 percent during March, while pork shoulders climbed 17 percent in Germany, according to Interporc, a Madrid-based industry group.

Needing Meat

China will boost its imports to plug a domestic pork shortage.

“The potential quantum of this is huge,” said Angus Gidley-Baird, a commodities analyst with Rabobank in Sydney. “It’s the biggest thing to affect the animal-protein market this year, and will probably have a lasting effect for a number of years. It will move markets and possibly influence geopolitical situations.”

The rally has spread to other meats. Australia’s beef exports to China surged 67 percent in the first quarter. In Brazil, shares in meatpackers such as JBS SA and Minerva SA have soared amid optimism of stronger sales to China.

Contagion Effect

Increased Chinese meat imports will result in higher food costs that impact on economies across the globe. The extent of those ripple effects depends on how quickly the epidemic can be stopped. Official data show a slowdown in the number of pigs affected since late 2018, supporting the government’s assessment that the disease is “under effective control.”

Analysts from Morgan Stanley to Citigroup Inc. to the U.S. Department of Agriculture aren’t convinced that the disease isn’t still spreading.

Pork is the largest component of China’s consumer price basket, and its influence on other meat prices means that a doubling of pork prices in China would boost the country’s inflation by 5.4 percent, all other things being equal, according to Citigroup, which is forecasting a 2.6 percent inflation rate for the country in 2019.

The Chinese government will likely treat any pork-related inflation as an extraordinary event separate from general cost increases, said Liu Ligang, chief China economist at Citigroup. in Hong Kong. Still, if rising pork prices elevate inflation beyond a ceiling rate of 3 percent, it could constrain the People’s Bank of China from taking aggressive measures to boost the economy.

Supply Shock

“The more field studies people tend to do, the more fear they tend to have,” Liu said. “This is a supply shock, not a demand shock, and as a result this could be transitory. But this could be a prolonged supply shock given the severity of the disease.”

The epidemic could have political repercussions as well. Xi Jinping may want to finalize trade negotiations with U.S. President Donald Trump to both ease the importation of much-needed pork, poultry and beef supplies, and to enable Chinese lawmakers to focus solely on quelling outbreaks, said INTL FCStone’s Suderman.

Officers inspect pork products intercepted from high risk areas of African swine fever.

Photographer: Costfoto/Barcroft Images via Getty Images

The contagion is also highlighting the urgent need for government investment in outbreak preparedness, said Amanda Glassman, chief operating officer at the Center for Global Development.

African swine fever in China shows that “animal and human disease surveillance systems are not working as well as they should,” she said. “This should concern everyone given that the potential economic impact of large-scale outbreaks is huge.”

Diffusion Pharma up ahead of capital raise

Thinly traded nano cap Diffusion Pharmaceuticals (DFFN +74.4%) breaks free of a near-term downtrend on a healthy 21x surge in volume.

The company is facing a capital raise, stating in March that it had resources to fund operations only into July.

The expected new capital will fund the advancement of lead candidate trans sodium crocetinate (TSC) for the treatment of stroke and cancer.

A Phase 2 clinical trial, PHAST-TSC, assessing TSC for the treatment of acute stroke in an in-ambulance setting should commence soon. Results should be available in ~two years, subject to sufficient funding.

A Phase 3 study, INTACT, evaluating TSC in patients with inoperable glioblastoma multiforme (GBM) (brain cancer) is ongoing. A Phase 2 trial showed a significant survival benefit in a subset of GBM patients compared to control.

What I Bet You Don’t Know About Health Savings Accounts

Health Savings Account plans are the fastest growing product in the health insurance marketplace. At last count, 25 million Americans were covered by an HSA plan and the account balances totaled $50 billion. That’s on a par with the gross domestic product of the entire state of Alaska. It’s more than the GDP of South Dakota, Montana, Wyoming or Vermont.

Readers of this post probably think they are quite familiar with HSAs. But did you know that:

- HSAs are the best savings vehicle available under the tax code?

- You can roll your IRA over into an HSA and, at some point in your life, you are foolish if you don’t?

- The best retirement savings strategy is to put the maximum into an HSA and never spend a dime of it until you get old?

- You can invest HSA funds just like you invest IRA funds and (again) you are foolish if you don’t?

I have to admit that I didn’t fully understand these things until I read HSAs: The Tax-Perfect Retirement Account by William Stuart. Most of what follows is based on Stuart’s analysis.

No other savings vehicle can top an HSA.

Not a 401(k) plan. Not an IRA. Not even a Roth IRA.

For starters, deposits to an HSA escape both income and payroll taxes. That can’t be said of the 401(k) deposit. It escapes the income tax, but not the payroll tax. That’s no small matter. Even without adding in the employer’s share, most Americans are paying more in payroll taxes than they are in income taxes.

As for the IRA, those deposits avoid the income tax. But if they are made from wage income, you don’t get any relief from the payroll tax.

During the retirement years, HSA withdrawals for non-medical purposes will face the income tax. But as I show below, your health expenses are going to be huge – larger than what most people realize. HSA withdrawals can be used to pay premiums for Medicare Part B, Part C and Part D, as well as any out-of-pocket medical expenses.

In all likelihood, your HSA funds will never be taxed at all.

By contrast, any withdrawal from an IRA or a 401(k) will be hit with income taxes, regardless of what you do with the money.

At age 70 ½, the government forces you to begin withdrawing (and paying taxes on) funds in your IRA and your 401(k) accounts. There is no such requirement for HSAs. Further, withdrawals from conventional accounts get included in assessing the tax on Social Security benefits. That does not happen with HSA withdrawals, even if you spend the money on non-medical consumption.

Withdrawals from Roth accounts are not taxed. But deposits are made after paying income and payroll taxes. Those are taxes that the HSA holder can expect to escape completely.

You can turn IRA funds into HSA funds.

In 2019, an individual can deposit up to $3,500 into an HSA account and up to $6,000 into an IRA. For reasons just given, you should choose the HSA deposit first. But suppose you do both. The law allows you a one-time roll-over opportunity, which you will want to delay until the retirement years.

At that point you can take funds that would otherwise be subject to forced withdrawals and income taxation and a possibly higher Social Security benefits tax and roll them into an account that can be part of your estate and that will not be taxed at all as long as withdrawals are for qualified medical purposes.

Your need for medical equity is higher than you think.

Stuart cites a Kaiser Family Foundation estimate that out-of-pocket medical expenses for a typical retiree average 41% of Social Security income today and that figure will rise to 50% by 2030. These expenses add up over time. Stuart cites a Fidelity estimate that a couple at age 65 today will spend $280,000 in medical expenses by the time they die. (These estimates include the Medicare premiums.)

HSAs work best when used as savings accounts rather than spending accounts.

In one example, Stuart compares two people, both age 37 and in the 30% tax bracket. They each forgo $3,000 of consumption – increasing that number by $50 a year for 30 years — in order to put funds into accounts that grow at a rate of 6%. At age 67, the one choosing to save through a 401(k) plan has accumulated $304,200 while the HSA saver has accumulated $329,400.

At that point, Stuart assumes annual medical care costs have reached $10,000 a year and they grow at a conventional rate. But because the 401(k) holder’s account is exhausted more quickly and because he must pay taxes on his withdrawals, he will experience a significant depletion of other wealth.

If both individuals live to 101, the 401(k) saver will have spent $409,000 from other accounts while the HSA saver will have withdrawn only $27,000.

Wise saving means wise investment.

Most HSA owners are not investing at all. They use their accounts as spending accounts. That may explain why the average balance in HSAs is only $2,000, However, the law allows account holders to invest funds the way people invest their IRA balances. About one in ten account holders is doing this. The average balance in their accounts is $14,000.

3M To Acquire Private Medtech Company Acelity For $6.7B

3M Co MMM 0.69% shares, which came under significant selling pressure following its disappointing first-quarter results April 25 and downward adjustment of full-year guidance, were seeing incremental weakness Thursday after the company announced a multibillion-dollar M&A deal.

What Happened

3M said it has agreed to acquire Acelity and its KCI subsidiaries worldwide from a private equity consortium — Apax Partners, the controlled affiliates of the Canadian Pension Plan Investment Board and the Public Sector Pension Investment Board — for about $6.7 billion, including the assumption of debt.

Acelity manufactures advanced wound care and specialty surgical applications that are marketed under the KCI brand.

3M expects the deal to be dilutive to its GAAP EPS by 35 cents in the first 12 months following the completion of the transaction, including the transaction costs. On an adjusted basis, the deal is accretive to EPS by 25 cents, 3M said.

Why It’s Important

3M has had a rough start to the year, with the manufacturer of Post-It notes and touchscreen displays reporting subpar first-quarter profits and reducing its full-year profit forecast. All five of its business units reported falling operating profits.

Citing headwinds in China and weak automotive and electronics markets, the firm also announced the elimination of 2,000 members of its workforce.

Against this backdrop, the deal relays optimism. In 2018, Acelity generated revenue of $1.5 billion.

“This acquisition bolsters our Medical Solutions business and supports our growth strategy to offer comprehensive advanced and surgical wound care solutions to improve outcomes and enhance the patient and provider experience,” 3M CEO Mike Roman said in a statement.

What’s Next

3M expects the deal to close in the second half of 2019, subject to customary closing conditions and regulatory approvals.

3M now expects 2019 share repurchases to be in the $1 billion to $1.5 billion range, down from the previous $2 billion to $4 billion.

The company said it expects to finance the deal from cash on hand and proceeds from the issuance of new debt.

CMS’ new tech innovation strategy targets ‘outdated’ regulation

CMS Administrator Seema Verma on Thursday unveiled new steps the agency is taking to bolster Medicare coverage of emerging medical technologies.

During remarks at the Medical Device Manufacturers Association’s annual meeting in Washington, Verma said the agency is removing what she called government barriers to innovation.

“When I came to CMS, I inherited outdated government rules and regulation that stifle innovation and access to innovative treatments,” she said. “Our often arcane and outmoded regulations around coverage, coding and payment can lead to unpredictability for innovators.”

The first CMS update would revamp the application process for codes under the Healthcare Common Procedure Coding System, or HCPCS.

Under the current system, the CMS only allows vendors to apply for new Level II codes once per year. The agency plans to redesign the process as a quarterly system for submissions and decisions related to drugs and a semi-annual system for submissions and decisions related to devices.

The second component clarifies coverage of Current Procedural Terminology, or CPT, temporary codes for emerging technologies, also known as category III codes.

For technologies that don’t fall under an existing Local Coverage Determination, Verma said Medicare contractors are not authorized to automatically forgo covering category III items and services. Instead, these contractors must follow the agency’s new Local Coverage Determination process for each decision they make. That process includes an evidence review of the technology in question.

These changes are part of the agency’s broader strategy to address barriers to innovation in the Medicare program, according to Verma.

“The advent of novel medical technologies requires CMS to remove barriers to ensure safe and effective treatments are readily accessible to beneficiaries without delaying patient care,” she said. “In essence, keeping new technologies and treatments moving from bench to bedside—and into the hands of those who need them most.”

As part of her remarks, Verma voiced opposition to Medicare for All-style proposals, saying “Medicare for All leads to innovation for none.”

The announcement builds on recent policies the CMS has proposed for emerging technologies.

Last week, the CMS proposed a new technology add-on payment for breakthrough medical devices that are significantly better than a device already on the market as part of its update to the hospital inpatient prospective payment system. Such devices already get expedited approval from the Food and Drug Administration.

Subscribe to:

Comments (Atom)