Prostate specific antigen (PSA) is the most commonly used biomarker in prostate cancer (PCa) but is far from being the ideal marker, resulting in a nearly 70% negative biopsy rate1 as well as overdiagnosis of clinically insignificant PCa2. The 4Kscore test (4K) has shown improved discrimination of clinically significant PCa (csPCa), reducing the number of required prostate biopsies3. Additionally, mpMRI also identifies a higher proportion of csPCa (18% more than transrectal ultrasound guided prostate biopsy) and lowers the rate of non-significant PCa diagnosis by 5%4. It has a sensitivity range of 44-87% and negative predictive value range of 63-98%5.

Recently, it was shown that the combination of 4K and mpMRI (4K-mpMRI) outperforms both tests individually in both area under the curve (AUC) and decision curve analyses6. However, attempts at devising a practical algorithm for 4K-mpMRI have yielded relatively weak sensitivities and low negative predictive values (NPV). In this presented study, the authors attempted to validate the combination of 4K-mpMRI and devise an improved algorithm for the identification of csPCa while limiting unnecessary prostate biopsies.

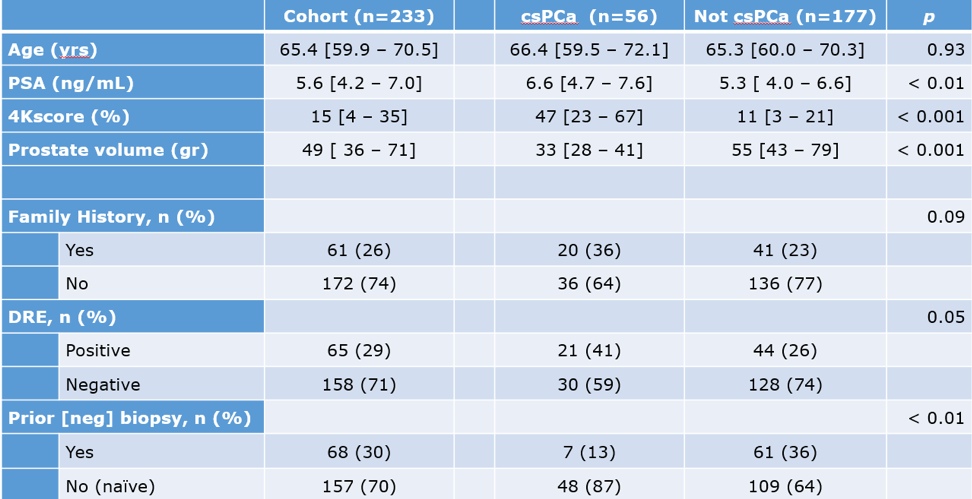

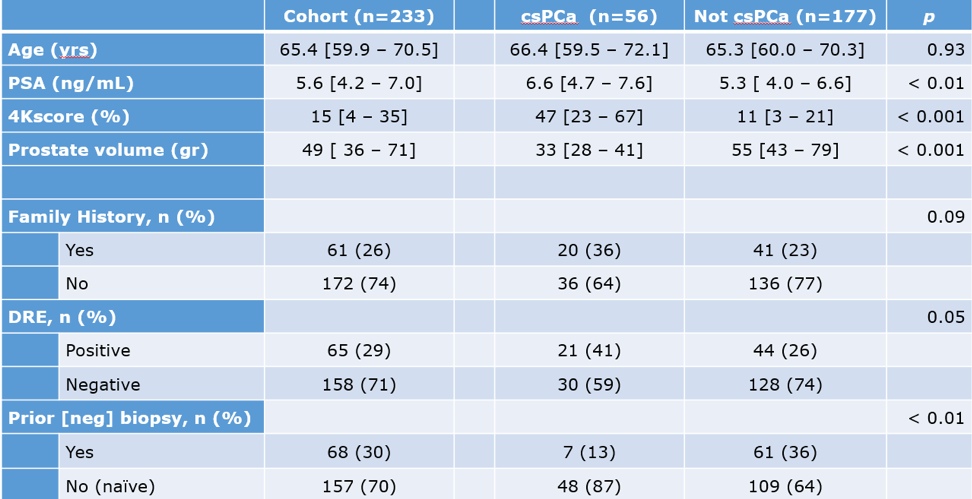

This was a retrospective study analyzing patients considered at risk for PCa and tested with 4K and mpMRI between the years 2016 and 2018. The primary outcome of csPCa was defined as Gleason grade group (GGG) >= 2 on prostate biopsy. 4K and mpMRI were compared via receiver operating characteristic (ROC) curves and logistic regression, and a model combining the two was tested for accuracy and efficiency. The 4K test was stratified to low (<7.5%) vs. high (>7.5%) risk disease, and mpMRI was stratified to PIRADS 3-5 vs. 0-2. The entire cohort consisted of 233 patients, and their basic clinical details are demonstrated in Table 1.

Table 1 – Basic clinical data of patients analyzed in the study:

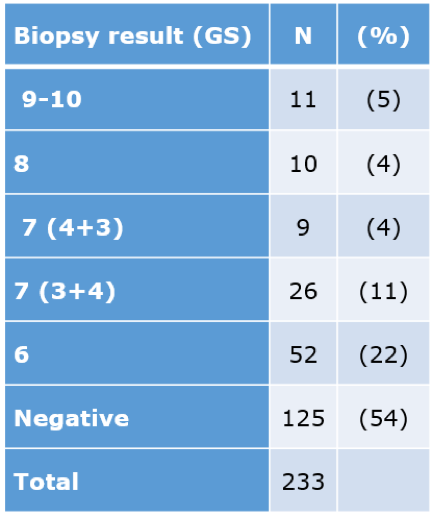

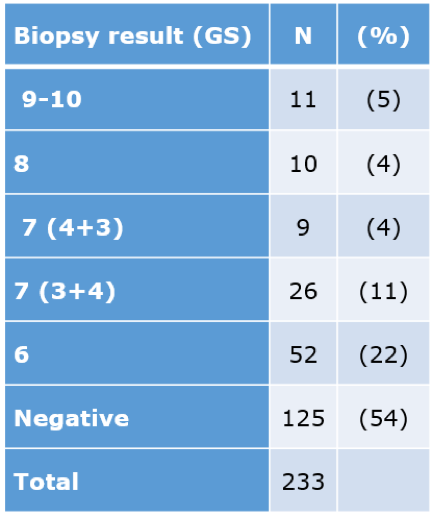

mpMRI results of csPCa and non-csPCa stratified by the PIRADS score are shown in table 2, and the biopsy results are shown in table 3. The biopsy results demonstrate that 177/233 (76%) had either a negative or GGG =1 biopsy result, meaning that 76% of the biopsies should potentially have been avoided.

Table 2 – mpMRI results:

Table 3 -Biopsy results

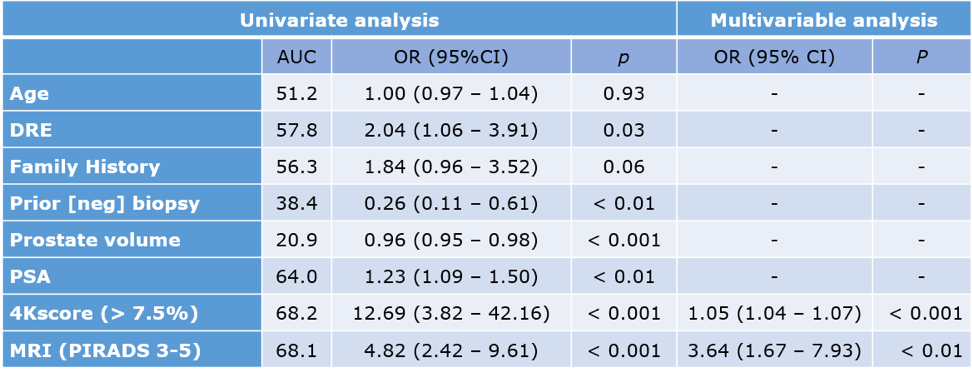

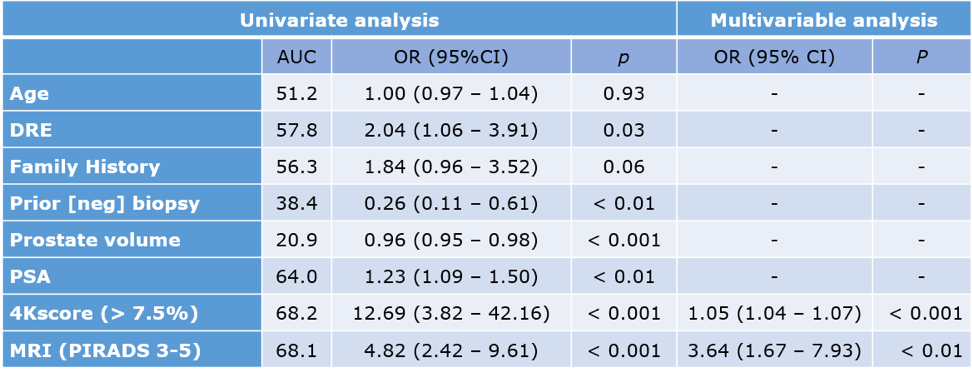

The univariable and multivariable models identified an association between csPCa and both 4K and mpMRI, as shown in table 4. The combination of 4K+mpMRI had resulted in an AUC of 0.796, and a sensitivity of 93%, specificity of 71%, positive predictive value of 50%, and a NPV of 97%, which is quite impressive.

Table 4 – Univariable and multivariable models:

Dr. Lubin concluded his excellent presentation and stated that the combination of 4K+mpMRI might be a potentially useful screening test, maintaining high sensitivity and dramatically improving specificity. Larger prospective multicenter studies are obviously needed to validate these results before widespread clinical implementation.

Presented by: Marc Lubin, MD, Mount Sinai Hospital, New-York, USA

b.

b.