Biotech startup Prelude Therapeutics (PRLD) has priced its initial public offering of 8.325M shares at $19/share, for expected gross proceeds of ~$158.2M.

Underwriters' overallotment is an additional 1,248,750 shares.

Shares to kick off trading today on the Nasdaq Global Select Market.

Offering is expected to close on September 29, 2020.

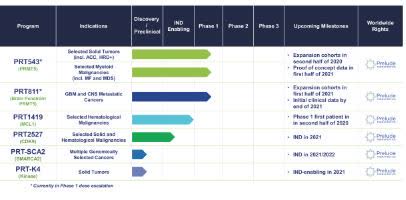

The Wilmington, DE-based biotech leverages its drug discovery engine to develop small molecule cancer therapies spanning methyltransferases, kinases, protein-protein interactions and targeted protein degraders for the potential treatment of solid tumors and blood cancers. Lead candidates PRT543 and PRT811 inhibit an enzyme called protein arginine methyl transferase 5 (PRMT5) that plays a key role in cancer cell growth and survival.

According to a 2019 market research report by ResearchAndMarkets, the global market for all solid tumor types was an estimated $121.3B in 2018 and is expected to exceed $424B by 2027.

The company's pipeline is summarized below: https://seekingalpha.com/news/3617243-prelude-therapeutics-prices-ipo-19-higher-end-of-expected-range-of-17-19

https://seekingalpha.com/news/3617243-prelude-therapeutics-prices-ipo-19-higher-end-of-expected-range-of-17-19

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.