Roughly two and a half months after Goldman's head of Global Commodities Research, Samantha Dart, laid out a timeline for what she called the "largest ever" LNG supply wave to hit global markets, she published a new client note late this week reiterating that the "supply wave is still on track."

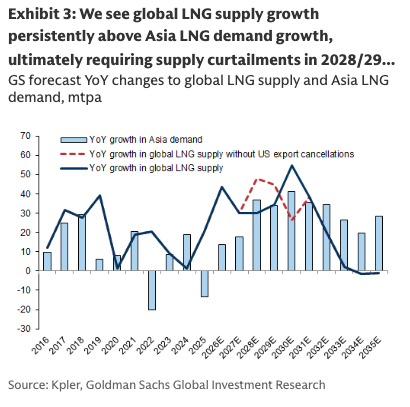

"2025 was year one of what we see as the largest ever global LNG supply wave, lasting seven years," Dart began the note, warning that "this wave is the main driver of a lengthy bearish cycle for European natural gas (TTF) and LNG (JKM), which we expect to bottom in 2028/29."

Dart forecasts that TTF and JKM will average below $5/mmBtu by the end of the decade, around 2028-29, compared with current TTF prices of around $41/mmBtu.

Here is Dart's update on the global LNG supply wave that is in year two, hitting markets:

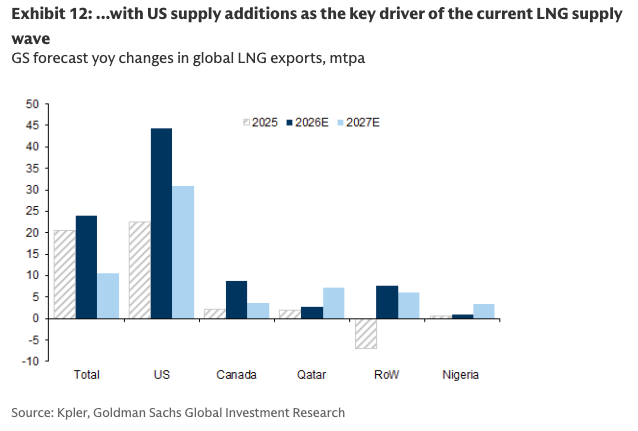

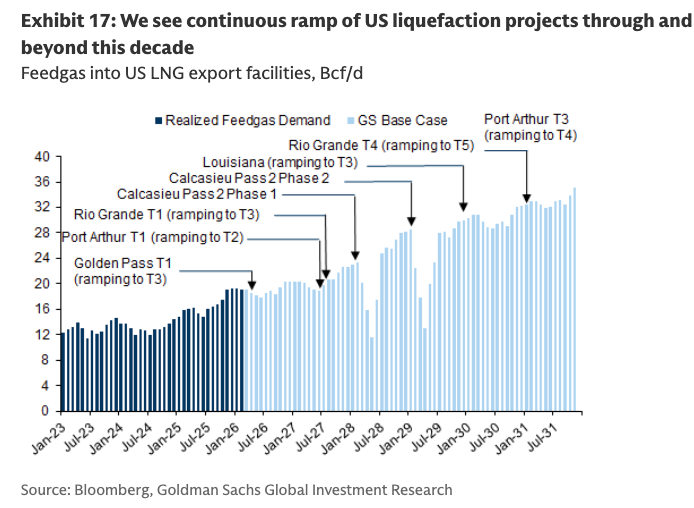

We see realized 2025 and forecasted 2026 LNG supply largely in line with our previous expectations, despite the recent US disruptions and recent delays to liquefaction capacity starts. Specifically, 2025 global LNG supply averaged 431 mtpa, only marginally below our 433 mtpa expectation as of end-2024, as a large beat in the US (driven by larger-than-expected ramp up at Plaquemines) was ultimately offset by smaller misses across existing LNG producers. We see some of these misses, like for Algeria and Indonesia, as likely structural, owing partly to growing domestic energy demand, and we incorporate further supply losses (-1 mtpa in total initially, but building to -3 mtpa in 2028-2030[1]) in our forward balances.

Global LNG supply has started 2026 below our previous expectations driven by export capacity start delays in the US, Canada, Congo and Australia, though by 4Q26 we expect supply to largely catch up with our earlier numbers.

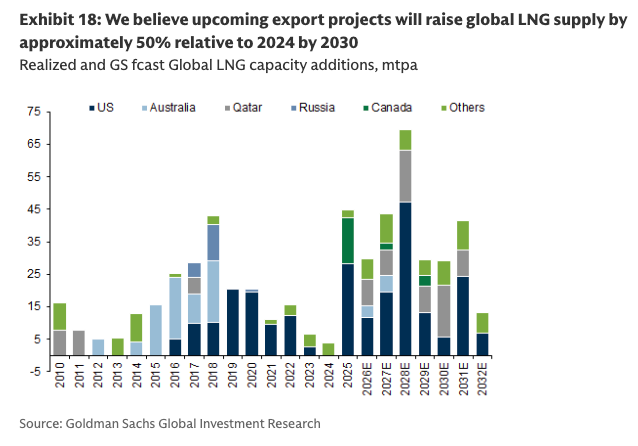

On net, we still expect 2025-to-2030 global LNG supply growth (+193 mtpa, 45% of 2025 global supply) to far exceed Asia demand growth (+144 mtpa), even taking into account our estimated demand response to low gas prices (>40 mtpa from China alone). We expect this oversupply to take European gas storage to congestion, particularly in 2028/29, leaving a temporary price-driven curtailment of US LNG exports as the likely solver of the imbalance in that period, in our view. We note that all but one of the supply projects in our balances through 2029 have already reached a Final Investment Decision (FID)[2].

The largest ever LNG supply wave is underway, and the early leadership is clear: U.S. capacity is ramping fastest and setting the tone for global balances.

Exhibit 18: The LNG supply wave has started.

Exhibit 12: Supply growth is being led by the U.S.

Exhibit 17: U.S. liquefaction start ups and ramp schedules, the core driver of incremental volumes.

Exhibit 3: Global LNG supply growth remains structurally above Asia demand growth, pushing the market toward a late decade pressure point. In 2028 to 2029, the implied balancing mechanism is supply curtailment, most likely via price driven reductions in US LNG exports as storage and logistics constraints tighten.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.