by Torsten Slok

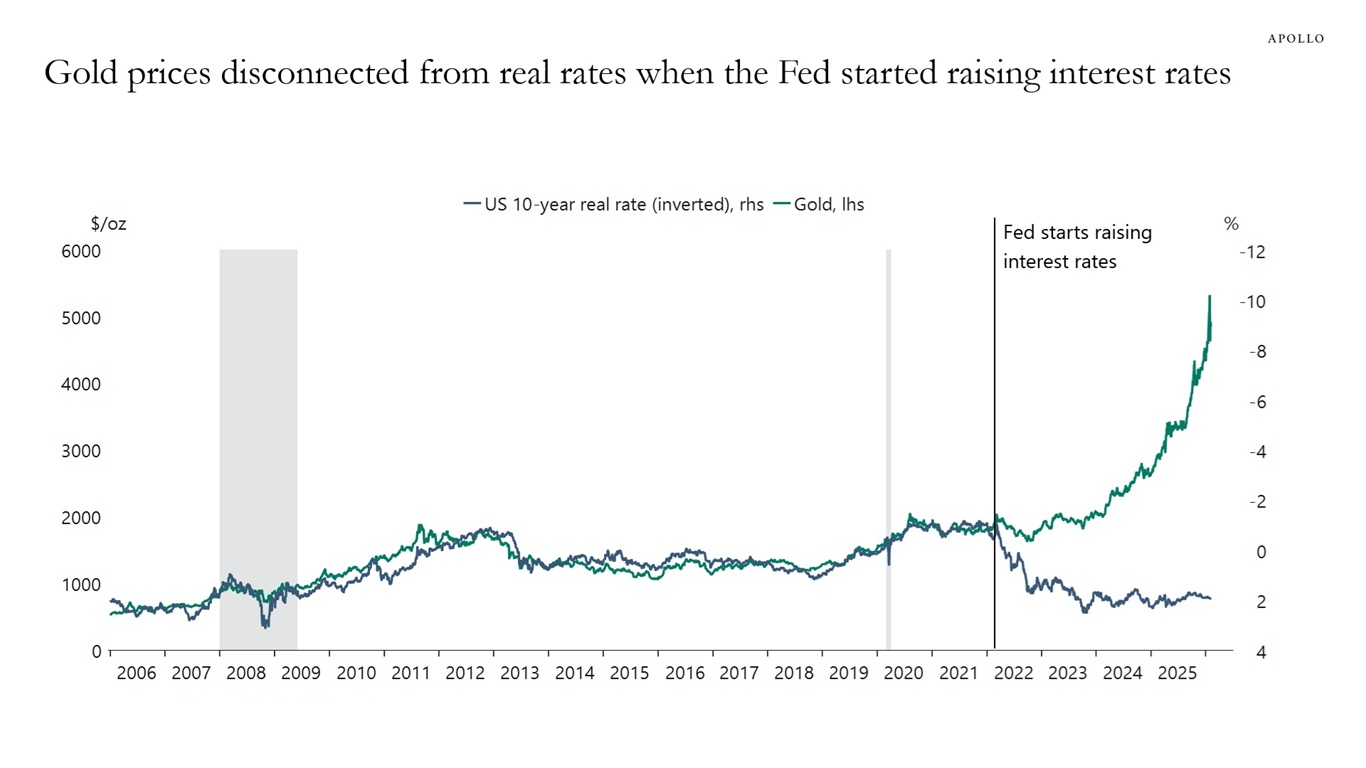

Much to the frustration of the quant community, when the Fed started raising interest rates in 2022, the strong correlation between gold and real rates broke down, see chart below.

It tells the market that when inflation and rates are high, investors begin to take other factors into consideration when they price future outcomes, and this has been particularly pronounced for the price of gold. In other words, quant models work best when inflation is stable at 2%, but this has not been the case since early 2021.

The bottom line is that new risks emerge when inflation is persistently above the Fed’s 2% target, which is where we continue to be today.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.