Markets were assailed by a trio of disruptive forces this year. Yet investors were rewarded for doing nothing.

If you owned U.S. stocks at the start of the year, you made good money. If you owned foreign stocks, even better. If you held Treasurys, you did well. And if you parked up in cash, the yield stayed high.\But doing nothing was hard as tariffs, loss of trust in America and artificial intelligence whipsawed portfolios. Streetwise spent the year documenting these three major market themes, and the wild ups and downs they sparked.

This column had a couple of great calls, to buy Treasurys at the start of the year and to fear tariffs when the market was insouciant about import taxes. There was a well-timed, but far too timid, call to buy back into stocks right at the April low. But I was overly concerned that the post-tariff rebound had overshot, and it ended up going up a lot further.

On tariffs, to maximize trading profit required getting three things right, and I only scored one-and-a-half out of three. First, recognize that the levies were a much bigger threat than the market thought. It took investors months to adjust to the fact that President Trump would focus on tariffs (and immigration) before the tax cuts and deregulation that they were so excited about after the election.

Second, see that the market had fallen too far. It’s hard to buy when panic reigns, but as a natural contrarian this is something I should get right. Instead, I only recommended investors “tiptoe” back in. They should have filled their boots.

And third, realize that Trump had shifted to a mode my former colleague Robert Armstrong memorably dubbed TACO, or Trump Always Chickens Out, so investors could relax about tariffs again. I continued to worry about presidential action hitting stocks for too long, and missed much of the recovery.

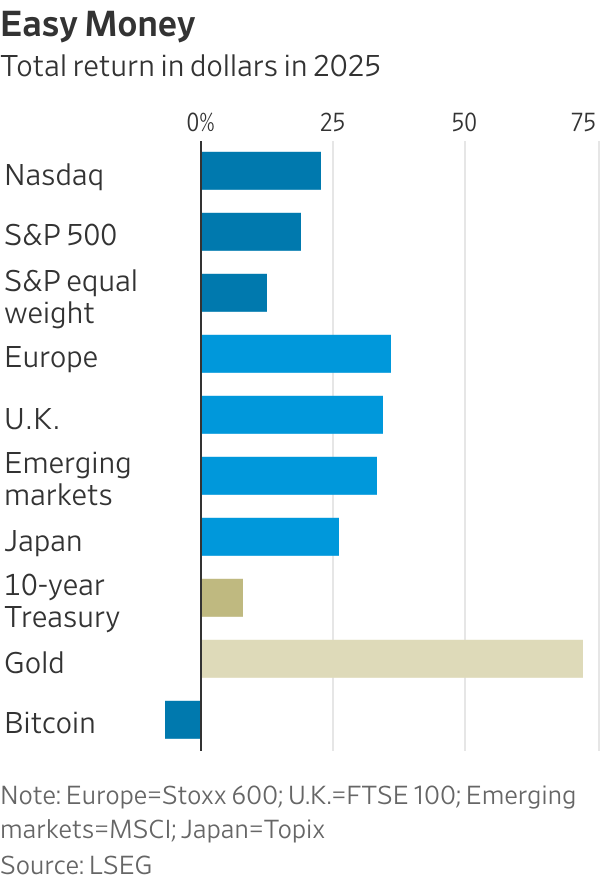

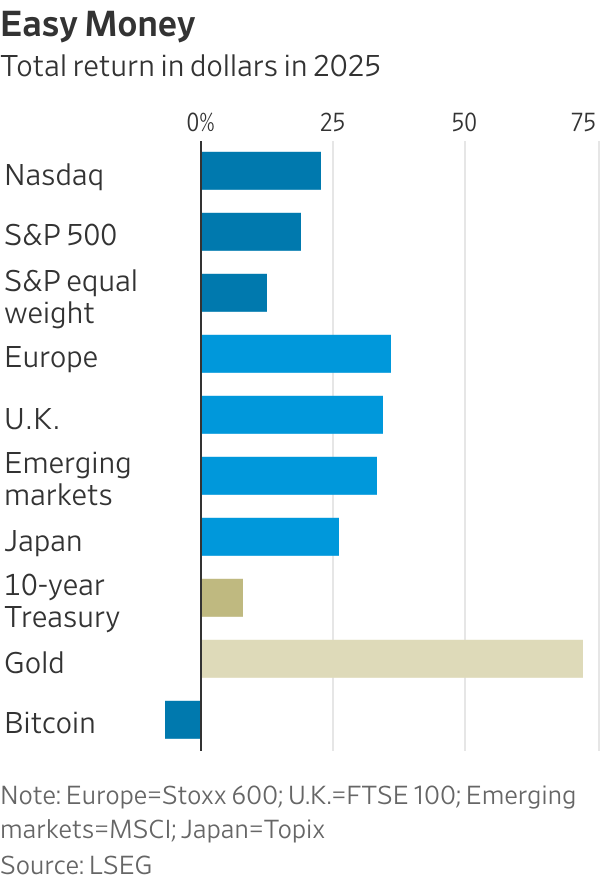

While TACO caught on, the ABUSA, or “Anywhere But U.S.A.,” trade also did extremely well. It was one of the best calls of the year as a cratering dollar and booming markets meant stocks in the U.K., Europe, Japan and emerging markets all beat both the S&P 500 and the Nasdaq composite. European stocks, propelled upward by German stimulus plans, soared 36% in dollar terms including dividends, almost double the S&P’s 19%.

Meanwhile, prices for AI stocks went from expensive to silly as investors encouraged executives to spend big in pursuit of human-level intelligence, before reverting to chasing AI that might make profits without eliminating the need for humans. The Nasdaq was down 21% this year at its April low. By October it had peaked with a 25% gain.

Easy Money

Streetwise was cautiously skeptical both about the biggest claims of AI proponents and that this was a bubble. But unbridled enthusiasm among private investors that led to late-summer silliness in stocks popular with day traders, especially anything bitcoin-related, worried me. As stock prices and capital spending plans rose relentlessly, the nature of many Big Tech stocks changed, and I grew increasingly concerned that a bubble was indeed inflating. We have to wait to find out if my concern is justified.

Easy Money

Streetwise was cautiously skeptical both about the biggest claims of AI proponents and that this was a bubble. But unbridled enthusiasm among private investors that led to late-summer silliness in stocks popular with day traders, especially anything bitcoin-related, worried me. As stock prices and capital spending plans rose relentlessly, the nature of many Big Tech stocks changed, and I grew increasingly concerned that a bubble was indeed inflating. We have to wait to find out if my concern is justified.

As talk grew about a “K-shaped economy,” or the idea that growth was being supported only by the wealthy while many suffered, there were evident parallels in the AI boom. The K-shaped stock market was obvious if you took account of moves in the dollar; in euro terms, the average S&P stock was down 3.7%, while the market-value weighted benchmark was up 1.4%. The outperformance of Big Tech explains the gap.

As we prepare for what seems likely to be another exciting year, the important questions are the same ones investors have confronted in 2025. Will the Federal Reserve become a patsy of the White House? Will inflation prove persistent again, and the economy stay resilient? Will tariffs stick? Will foreigners keep buying into the U.S.? And does AI have to demonstrate an actual business model to retain investor dollars?

My hope is that the Fed gets a chair willing to focus on the economy and ignore political pressure, but I’m not confident. I can’t predict how the Supreme Court will rule on tariffs, but if they are knocked down, it would be a great excuse for Trump to drop them and move on to more market-friendly parts of his agenda. Again, I’m not confident he will.

Foreign investors have been given lots of reasons to stick to their local markets in 2025, and overseas stocks remain a lot cheaper than U.S. ones. Yet, as long as the AI craze continues, it will keep sucking in foreign money.

https://www.msn.com/en-us/money/markets/in-a-wild-year-for-markets-investors-who-did-nothing-did-just-fine/ar-AA1T9y3y

As we prepare for what seems likely to be another exciting year, the important questions are the same ones investors have confronted in 2025. Will the Federal Reserve become a patsy of the White House? Will inflation prove persistent again, and the economy stay resilient? Will tariffs stick? Will foreigners keep buying into the U.S.? And does AI have to demonstrate an actual business model to retain investor dollars?

My hope is that the Fed gets a chair willing to focus on the economy and ignore political pressure, but I’m not confident. I can’t predict how the Supreme Court will rule on tariffs, but if they are knocked down, it would be a great excuse for Trump to drop them and move on to more market-friendly parts of his agenda. Again, I’m not confident he will.

Foreign investors have been given lots of reasons to stick to their local markets in 2025, and overseas stocks remain a lot cheaper than U.S. ones. Yet, as long as the AI craze continues, it will keep sucking in foreign money.

https://www.msn.com/en-us/money/markets/in-a-wild-year-for-markets-investors-who-did-nothing-did-just-fine/ar-AA1T9y3y

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.