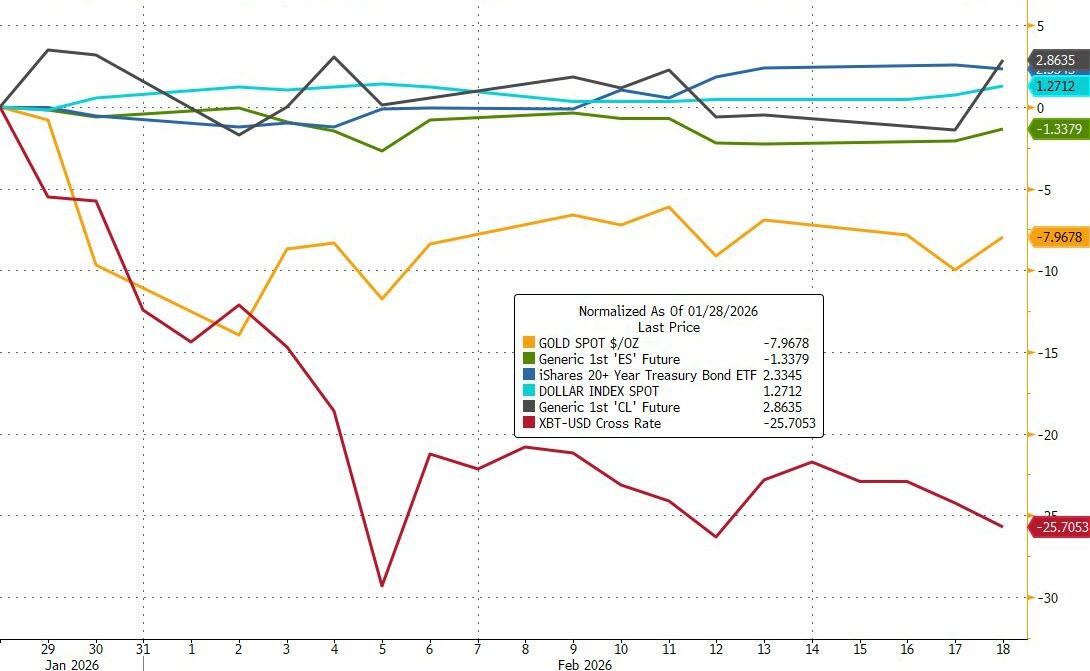

Since the last FOMC meeting (where they held rates with two dovish dissents) on Jan 28th, Bitcoin has been the biggest underperformer (along with gold) while bonds and the dollar have rallied with stocks lagging...

Source: Bloomberg

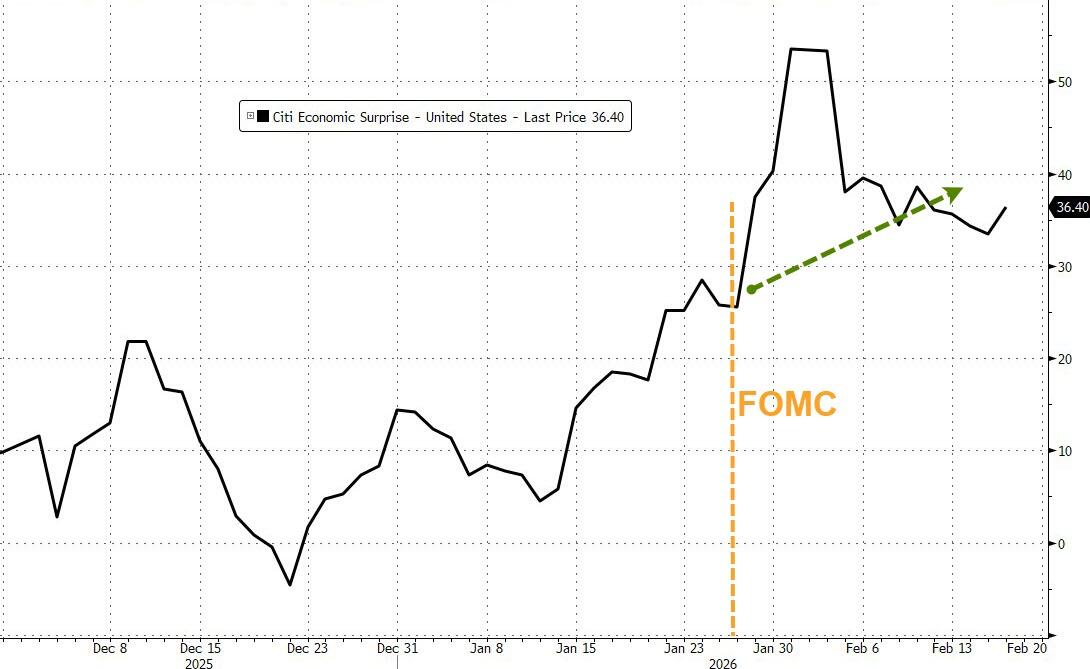

March is 'off the table' for a rate-cut now (following last week's payrolls beat) but overall 2026 rate-cut expectations are dovishly higher since the last FOMC meeting...

Source: Bloomberg

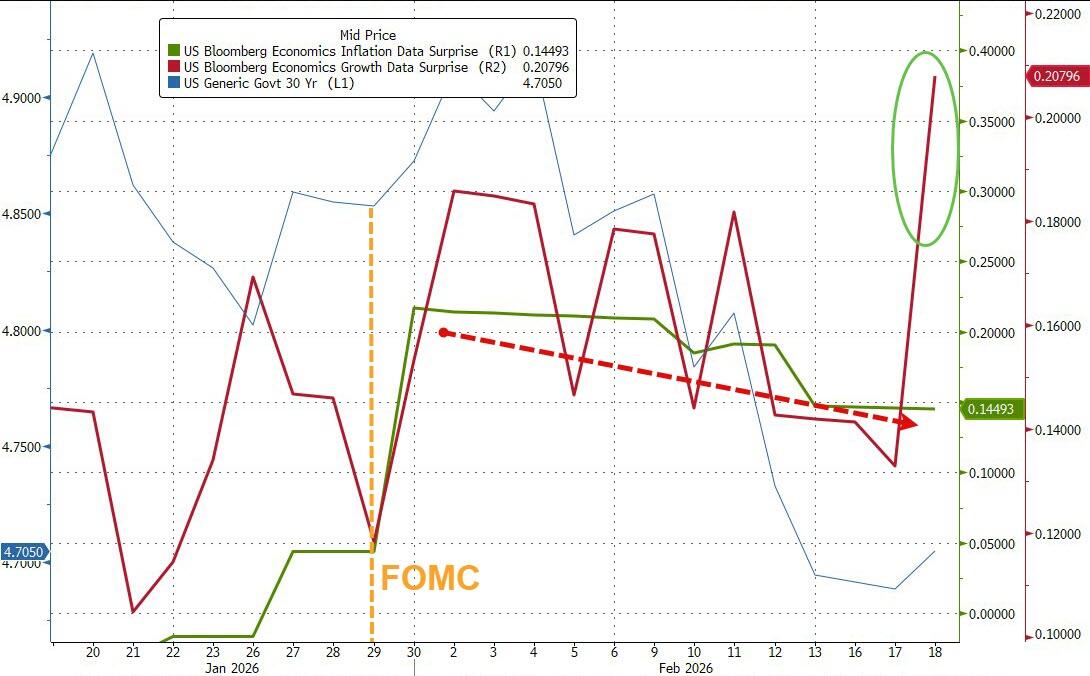

With macro data confirming Powell's positive narrative (for now)

Source: Bloomberg

With Growth surprising to the upside and inflation drifting lower...

Source: Bloomberg

Today's Minutes could be more interesting than recent months since The Fed displayed a hawkish tone with Powell talking up a “clear improvement” in the US outlook during the press conference, and said the job market shows signs of steadying.

So here's what The Fed wanted you to know about the last FOMC Meeting:

A very divided Fed sees more rate-cuts (or hikes) possible and embraces lower inflation (and fears higher inflation)... (h/t Newsquawk)

Policy outlook & rate guidance

Almost all supported maintaining 3.50-3.75%, while a couple preferred a 25 basis point cut, citing restrictive policy and labor market risks.

Several said further rate cuts would likely be appropriate if inflation declines as expected.

Some judged rates should be held steady for some time pending clearer disinflation evidence.

Some said it would likely be appropriate to hold the policy rate steady for some time while assessing incoming data.

A number judged further easing may not be warranted until clear evidence shows disinflation is firmly back on track.

Several favored two-sided guidance, noting upward adjustments could be appropriate if inflation remains above target.

Vast majority saw downside employment risks as moderated, while inflation persistence risks remained; some judged risks more balanced.

Several warned further easing amid elevated inflation could signal reduced commitment to 2% goal.

A few cautioned overly restrictive policy could significantly weaken labor conditions.

Neutral rate & financial conditions

Those favoring no change said, after 75 basis points of cuts last year, policy was within estimates of neutral.

Most expected growth support from favorable financial conditions, fiscal policy, or regulatory changes.

Inflation views

Inflation had eased markedly from 2022 highs but remained somewhat elevated relative to 2%.

Elevated readings largely reflected core goods boosted by tariffs; some noted continued disinflation in core services, especially housing.

Most cautioned progress toward 2% may be slower and uneven; risk of persistent above-target inflation seen as meaningful.

Some cited business contacts planning price increases this year due to cost pressures, including tariffs.

Several said sustained demand pressures could keep inflation elevated.

Several expected ongoing housing services moderation to exert downward pressure on inflation.

Several anticipated higher productivity growth would help restrain inflation.

A few reported firms automating to offset costs, reducing need to raise prices or cut margins.

Most longer-term inflation expectations remained consistent with 2%; several noted near-term expectations had declined from spring peaks.

Labor market & growth

Most said unemployment, layoffs and vacancies suggested stabilization after gradual cooling.

Almost all observed layoffs remained low but hiring was also subdued.

Several said contacts remained cautious on hiring amid outlook and AI uncertainty.

Some cited lower net immigration as contributing to weak job gains.

Vast majority judged stabilization signs and diminished downside labor risks.

Most nonetheless said downside labor risks remained, including sharp unemployment increases in a low-hiring environment.

Some pointed to soft survey measures and part-time for economic reasons as signs of lingering weakness.

Activity seen expanding at solid pace; consumer spending resilient, supported by household wealth.

Several cited disparity between strong higher-income and soft lower-income consumer spending.

Several noted robust business investment, particularly in technology; several judged productivity gains would support growth.

Agricultural commentary

A couple said the crop sector remained weak, while livestock stayed strong.

Read the full FOMC Minutes below:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.