A fresh reminder that the K-shaped economy remains a very big problem emerged Tuesday at the Consumer Analyst Group of New York (CAGNY) conference, where top U.S. packaged food executives struck a sour tone about persistent consumer softening and unease over elevated food prices.

General Mills CEO Jeff Harmening told the audience at CAGNY that cereal, snacks, and pet food are among the categories taking the biggest hit as consumers struggle with affordability woes. He said the pressure is being fueled by inflation, reductions in government food benefits, geopolitical uncertainty, and a fragile consumer environment.

Those factors "have led to significant consumer stress, especially for the middle- and lower-income groups," Harmening said.

Also on Tuesday, General Mills plunged 7% (its biggest drop since May 2022) after cutting its full-year sales outlook. It now expects organic net sales to decline 1.5% to 2%, compared with its prior forecast of down 1% to up 1%.

BNP Paribas analyst Max Gumport told clients CAGNY was "one of the most downbeat in recent memory for the packaged food group." He noted the group is still facing several headwinds that have contributed to a "more elongated than anticipated recovery in volume."

Beyond a cash-strapped consumer, Gumport also cited the surging use of GLP-1 drugs, intensifying competition from "disruptor" brands, and ongoing financial stress as some of the top pressures across the packaged food industry.

Also at the conference, Dana McNabb, group president of North America retail at General Mills, said the company has implemented a new lower-pricing strategy that has lifted volumes by eight percentage points.

McNabb said General Mills is targeting the price points that deter purchases and keeping prices below those thresholds. She added that the company is taking about 20% of its "least productive" products off the market.

Mondelēz International CEO Dirk Van de Put told CAGNY that consumers have dialed back on snack buying "because of high prices and flat spendable income."

UBS analyst Torsten Sippel commented on the market reaction on Wednesday, saying: "Staples are finally pulling back after several weeks of outperformance, following disappointing guidance from General Mills. Packaged Food {UBXXFOOD Index} is down 4%."

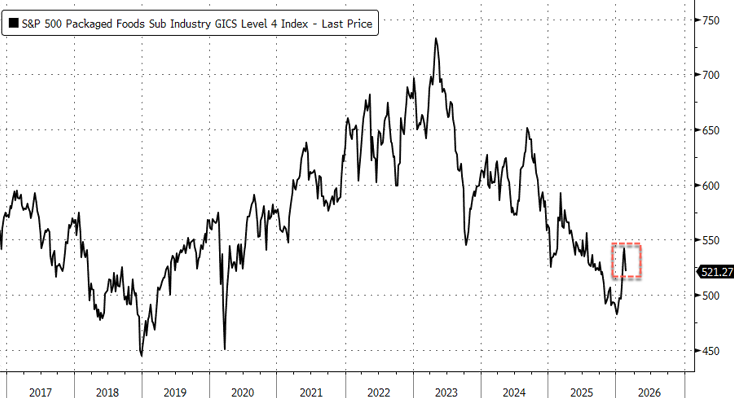

The S&P 500 Packaged Foods Sub-Industry Index closed down nearly 4%, not far from its Covid lows.

Our view is that consumers are addicted to junk food and are likely only temporarily dialing back spending in this segment as they look for new ways to fund their habits.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.