Search This Blog

Monday, November 3, 2025

Vertex’s Cystic Fibrosis Sales Beat, as Newer Drugs Miss

Vertex Pharmaceuticals Inc. reported third-quarter sales that beat analysts’ expectations as the biotech company’s mainstay cystic fibrosis treatment saw revenue growth, even as new drugs’ performances disappointed Wall Street.

Vertex reported revenue of $3.08 billion, an 11% gain from one year ago. That was ahead of analysts’ forecasts and was driven in large part by an increase in sales for its cystic fibrosis treatment, Trikafta.

The problem with Obamacare is Obamacare

This year, the COVID-induced expansion of the Affordable Care Act (ACA) will expire. Extending the expanded subsidies has become a point of contention between Republicans and Democrats, and the clock is ticking. Marketplace enrollees will start choosing their plans in a month.

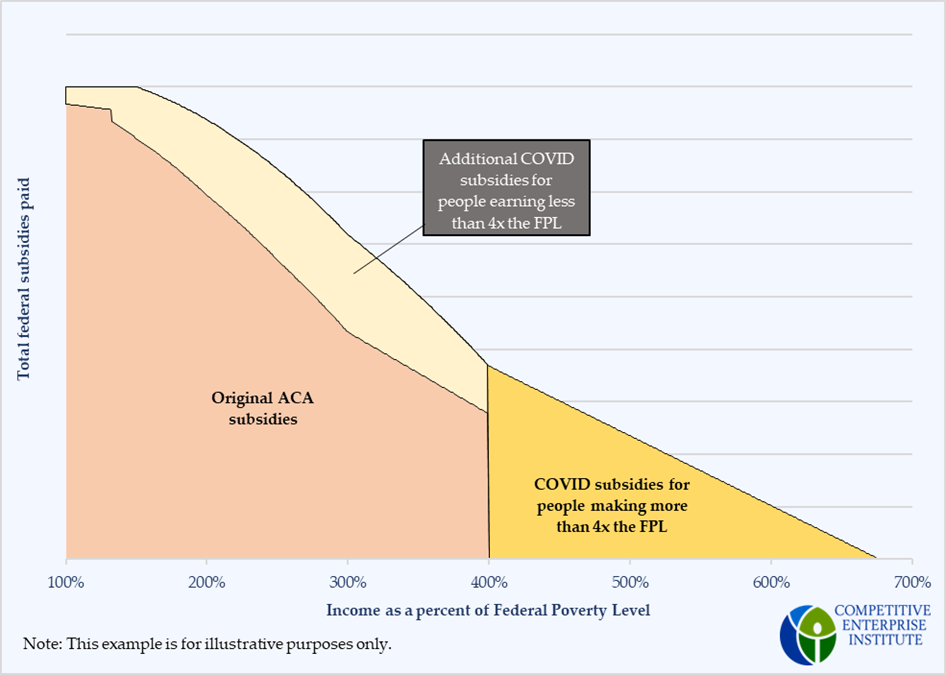

The expansion of ACA subsidies can be broken into two components. Originally, the ACA provided subsidies only for people earning between the federal poverty level (FPL) and four times the federal poverty level (between 100 percent and 400 percent of the FPL for short). Those subsidies decreased with income, so that the higher the income (or, the farther away from poverty), the more the individual was expected to pay, and the lower the taxpayers’ share would be. If a person was in a household that earned more than four times the federal poverty level, there were no subsidies at all.

The COVID expansion of Obamacare/ACA expanded the subsidies in two ways. It increased subsidies for people earning less than 400 percent of the FPL, but for the first time, it also provided subsidies for people above the cutoff. These were designed just as those in the original ACA were, to phase out gradually as income increases.

The figure below illustrates how subsidies would change with income, and how the expanded subsidies compare with those originally legislated.

Today, a major argument from the left to extend subsidies is that people above 400 percent of the FPL cannot afford health insurance without the subsidies.

Those on the right are turning this argument against the ACA itself, saying that it was supposed to “bend the [health care] cost curve downward” and reduce premiums by $2500/year. They argue that if insurance is still not affordable, or less affordable, after more than a decade under the law, then the Affordable Care Act failed at its titular objective.

In fact, the unaffordability of health insurance for people above the cutoff does demonstrate how the ACA failed. One of the reasons the 400 percent FPL cutoff was put in place was that, when the law was written, premiums were much more affordable for this group.

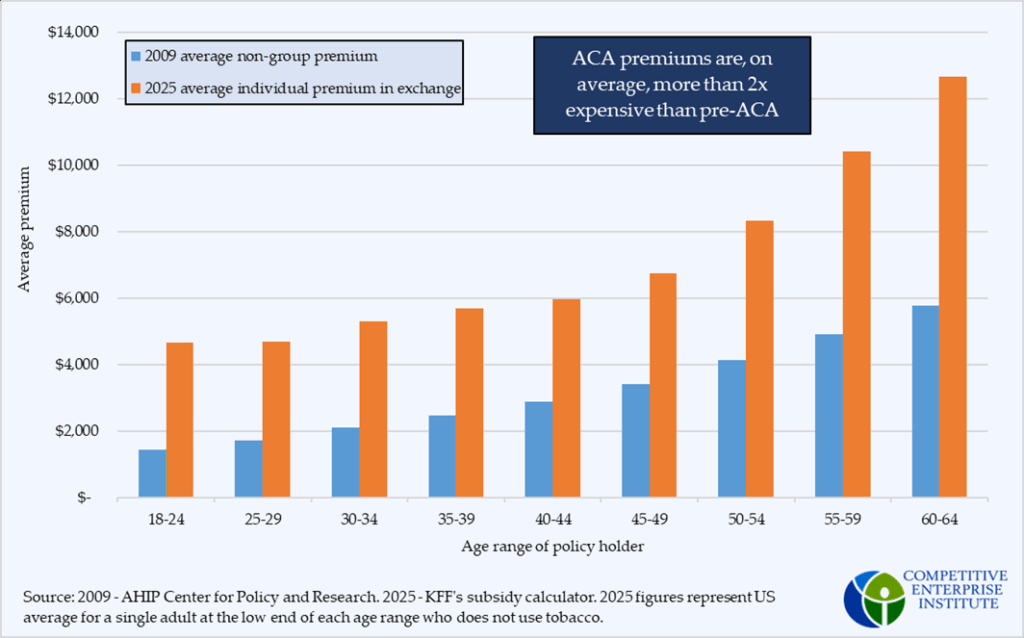

The Affordable Care Act was written primarily in 2009. At that time, premiums for direct purchase insurance were much lower than they are today. According to the a study done by the America’s Health Insurance Plans (AHIP), in 2009, average premiums for non-group insurance plans cost an average of $2,985/yr (all dollar figures are nominal) for individuals, and $6,328 for families. For a 60 year-old individual, the average cost of a policy was $5,755. Across all ages, premiums for marketplace coverage are higher than individual insurance was in 2009.

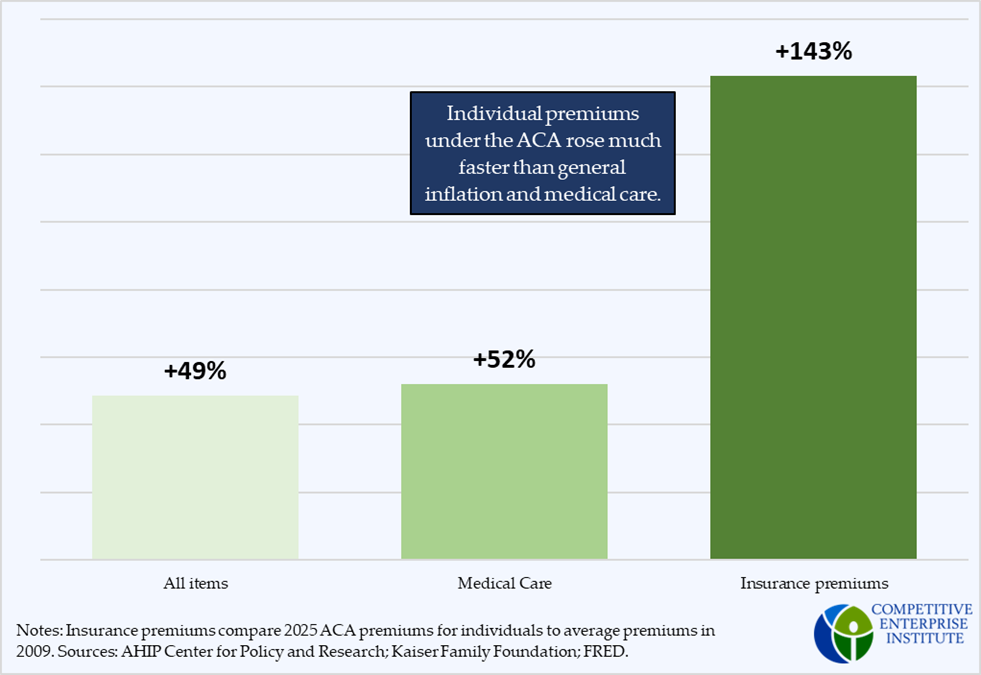

On average, premiums have more than doubled in nominal terms since then. Medical care, notorious for its high inflation rate, has only risen 51 percent and overall prices have risen 49 percent, including the high inflation during the Biden administration.

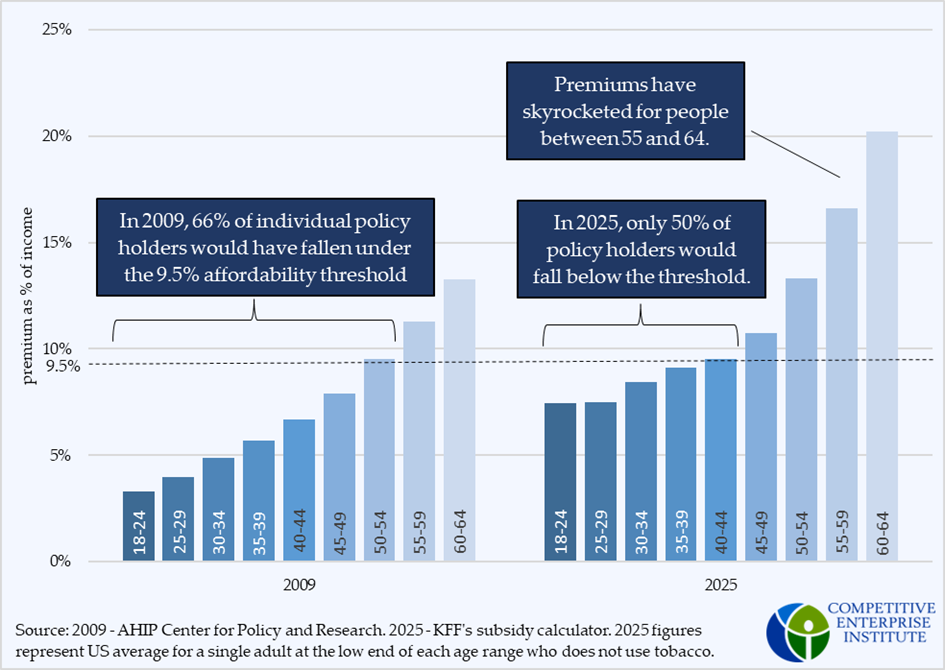

The Affordable Care Act defined affordability as a percentage of income, so to show the failure of Obamacare and why many are saying the cutoff needs to be removed, it is necessary to consider premiums as a percentage of income as well.

In 2009, the poverty level for a single-person family was $10,830. By 2025, it had risen to $15,650. In 2009, insurance premiums amounted to less than 9.5 percent of total income for 2/3 of individual policyholders, which was the “affordability threshold” set for people earning between 300 and 400 percent of the federal poverty level. The ACA could have applied that same level to those above 400 percent, meaning people in this income range would be expected to contribute a larger proportion of their income. It is likely, too, that for people earning more than 400 percent, the ACA would have set a higher affordability threshold than 9.5 percent.

People who could purchase insurance and pay less than the affordability threshold would receive no federal subsidies, because the ACA deemed insurance as “affordable” for these people. Consequently, the architects of Obamacare didn’t believe it was necessary to extend the subsidies beyond 400 percent of the federal poverty level, because few would need them with premiums of the time.

However, once Obamacare went into effect, premiums increased substantially. Now, around half of people at the income cutoff wouldn’t be able to afford insurance, according to the ACA’s affordability standard, and would deserve subsidies under the original Obamacare framework. The increase in premiums between 2009 and 2025 is most evident for people older than 50, which is why Democrats’ examples of unaffordability frequently include these individuals.

If the ACA had worked as promised, premiums would have risen much slower than they have. In fact, premiums have risen so fast, it has undercut the original design of the program, and now, politicians are calling for an expansion. In any context, it is unwise to spend additional money on a failed program without reforming it to fix the underlying problem, and it is no different with the ACA.

Jeremy Nighohossian is a senior fellow and economist at the Competitive Enterprise Institute, focusing on health care policy.

https://cei.org/blog/the-problem-with-obamacare-is-obamacare/

KUDLOW: Will economic illiteracy be the big winner tomorrow night?

You've got rent freezes from socialist Mamdani and a freeze on utilities by New Jersey’s Miki Sherrill.

Of course, economic illiteracy for Mamdani comes way too easily. He wants to give everything away for free. My favorite is his Soviet-style supermarkets. If you can find anybody who lived through any of the 70 years of Soviet communism, please ask them how well the shelves were stocked with fresh food during the communist period. It was a disaster.

And of course, add up Mamdani’s free spending ways, and you get a number that’s almost equal to the current New York City budget. And much bigger than the budget of the New York police department.

But rent freeze which covers roughly half of renters simply means that the apartments will spiral down into total disrepair because owners won’t make any money or break even. They will lose their investment. Price controls of any kind never work. Ever. But tell that to New Jersey gubernatorial candidate Mikie Sherrill who’s very proud of her utility cost freeze. Of course she doesn’t understand it because she’s a big greeny.

But here’s the point. You freeze utility rates then the electric utility companies in New Jersey will never be able to upgrade services or install the latest technologies. Or how about putting in pipelines to bring in low cost affordable natural gas or even building some of these new modular nuclear plants. That’s the solution. Not a freeze.

The trouble is during Governor Phil Murphy’s days, he was interested in offshore windmills. And what he got was onshore dead whales. How very clever of him.

And I count him as a personal friend, and I also recall that he was a big capitalist as a senior partner at Goldman Sachs. But when he put on that Governor’s crown of thorns, he just went way left socialist green new deal. And the voters of New Jersey are apparently furious at sky-rocketing utility rates.

Of course, the utility companies in New Jersey are owned by investors and by union pension funds. So, a rate freeze would kill them too. But the long and the short is economic illiteracy is alive and well in the Democratic Party. But you already knew that.

https://www.foxbusiness.com/politics/larry-kudlow-economic-illiteracy-big-winner-tomorrow-night

Starbucks to sell majority stake in China business

Starbucks says it is selling a 60% stake in its business in China as part of a $4bn (£3.04bn) deal with investment firm Boyu Capital.

Under the agreement, the world's biggest coffee chain will have a 40% stake in the Chinese retail operation and retain ownership of the Starbucks brand there.

Starbucks entered China in 1999 and the country is now its second-largest market outside the US, but has struggled in recent years with the rise of homegrown brands like Luckin Coffee.

The business will continue to be headquartered in Shanghai and will own and operate 8,000 outlets in the Chinese market, with plans to grow to as many as 20,000 locations, the firm said on Monday.

The partnership with Boyu is a "significant milestone" and signals its plans for long-term growth in China, Starbucks said as it put a $13bn valuation on its retail operations in China.

The collaboration "combining Starbucks globally recognised brand, coffee expertise, and partner (employee)-centred culture with Boyu's depth of understanding of Chinese consumers," it added.

Starbucks said it plans to introduce new drinks and digital platforms in China, adding that the deal will be finalised next year.

Boyu Capital is a private equity firm that invests in retail, financial services and technology businesses. The company has offices across Asia, including in Shanghai, Hong Kong and Singapore.

Starbucks' future in China had been uncertain for months after former boss Laxman Narasimhan said last year that the company was exploring "strategic partnerships" to stay competitive in the world's second largest economy.

The agreement marks one of the biggest deals involving the Chinese operations of a global consumer company in recent years.

KFC and Pizza Hut's operations in China were spun off by their owner Yum! Brands in 2016 after struggling in the country for years.

Other major US brands like fashion chain Gap and ride-hailing platform Uber have also faced challenges in China.

In recent years, Starbucks has seen falling sales in China, due to the Covid-19 pandemic, slower consumer spending and fierce competition.

Beijing-based Luckin Coffee now runs more shops in China than Starbucks and has won a loyal following with its lower prices and frequent discounts.

Starbucks has also cut its prices in the country in a bid to compete with domestic rivals, but this has had an impact on its profits.

Since being appointed as Starbucks' chief executive last year, Brian Niccol has been on a mission to turn around the global business.

The former Chipotle boss has led a revamp of Starbucks' menu, and has said he would hire more baristas while scaling back automation efforts.

The chain has more than 40,000 outlets around the world.

https://www.bbc.com/news/articles/cn0g90376j5o

Novo Nordisk's Wegovy could soon have a new sales outlet in the U.S.

'Active discussions' being held, telehealth company Hims & Hers says

Wegovy pens at a Chicago pharmacy. Telehealth company Hims & Hers says that it could be selling the GLP-1 medication on its platform soon.

Telehealth company Hims & Hers Health Inc. said late Monday it is in "active discussions" with Denmark's Novo Nordisk A/S to make Wegovy available on its platform.

The discussions are about both Wegovy injections and an oral Wegovy, which is under evaluation in the U.S. and would be the first pill formulation of a GLP-1 medication if approved. The Food and Drug Administration is expected to rule on the oral Wegovy by the end of the year.

Hims & Hers said that the discussions with Novo Nordisk (DK:NOVO.B) are ongoing, that "no definitive agreement" has been reached, and that the two companies may not reach one. Nonetheless, Hims & Hers shares (HIMS) shot up 5.7% in the after-hours session Monday, after ending the regular trading day down more than 2%.

The disclosure of talks around the GLP-1 drug came as Hims, known for its streaming-TV commercials about erectile dysfunction, hair loss and other ailments, reported its third-quarter earnings.

The company reported third-quarter per-share earnings of 6 cents on revenue of $599 million, up 49% year over year. The EPS came in line with FactSet consensus, while revenue topped views.

Hims also reported a 21% growth in the number of subscribers in the quarter, to 2.5 million people.

The company said it expects revenue between $605 million and $625 million in the fourth quarter, and of $2.335 billion to $2.355 billion for the full year. Both outlooks are above expectations.