Rate-cut expectations have surged (dovishly) higher this week (along with tumbling Treasury yields) amid a mixed macro picture (Labor market 'good', Retail sales bad, Housing ugly).

Today could change all that as CPI for January prints with risk skewed to the upside. January brings annual resets and they tend to surprise on the high side.

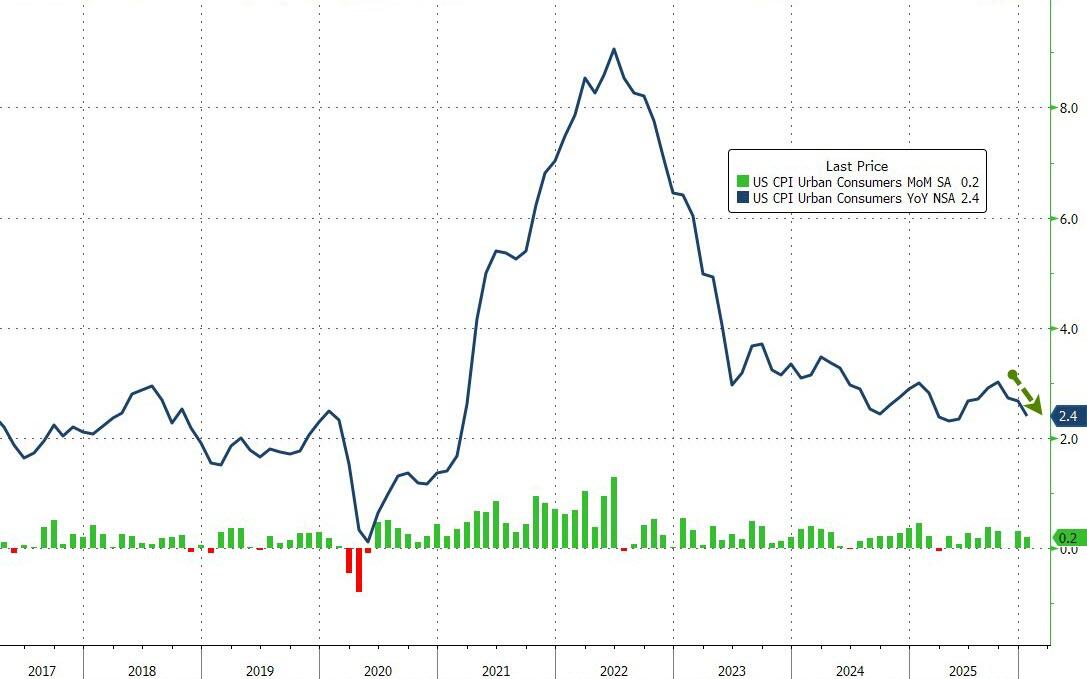

Despite the 'hot' whisper numbers (and 4 previous Januarys in a row of upside surprises), headline consumer price inflation came in cooler than expected in January (+0.2% MoM vs +0.3% expected). That pulled the headline CPI down dramatically from +2.7% to +2.4% - near the lowest in 4 years...

Source: Bloomberg

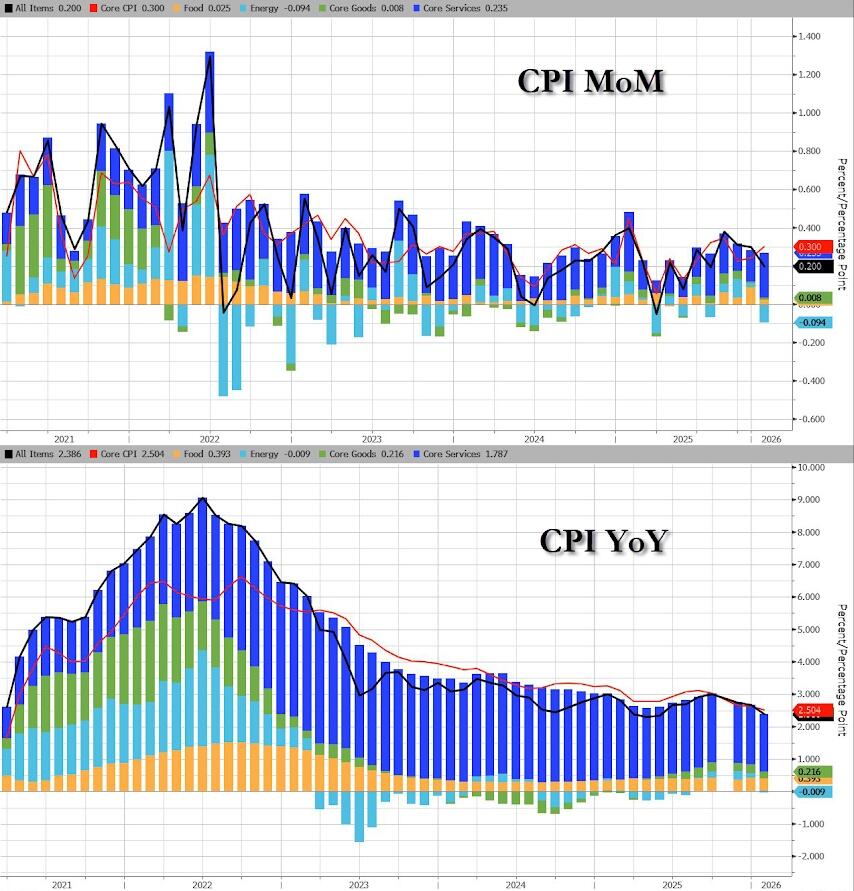

Food cost inflation is slowing, Energy is deflating...

Core CPI printed +0.3% MoM (in line with expectations), lowering the YoY change in core prices to +2.5% - the lowest since March 2021...

Source: Bloomberg

Goods inflation is clearly lacking (despite UMich respondents being sure we'd by hyperinflating by now)...

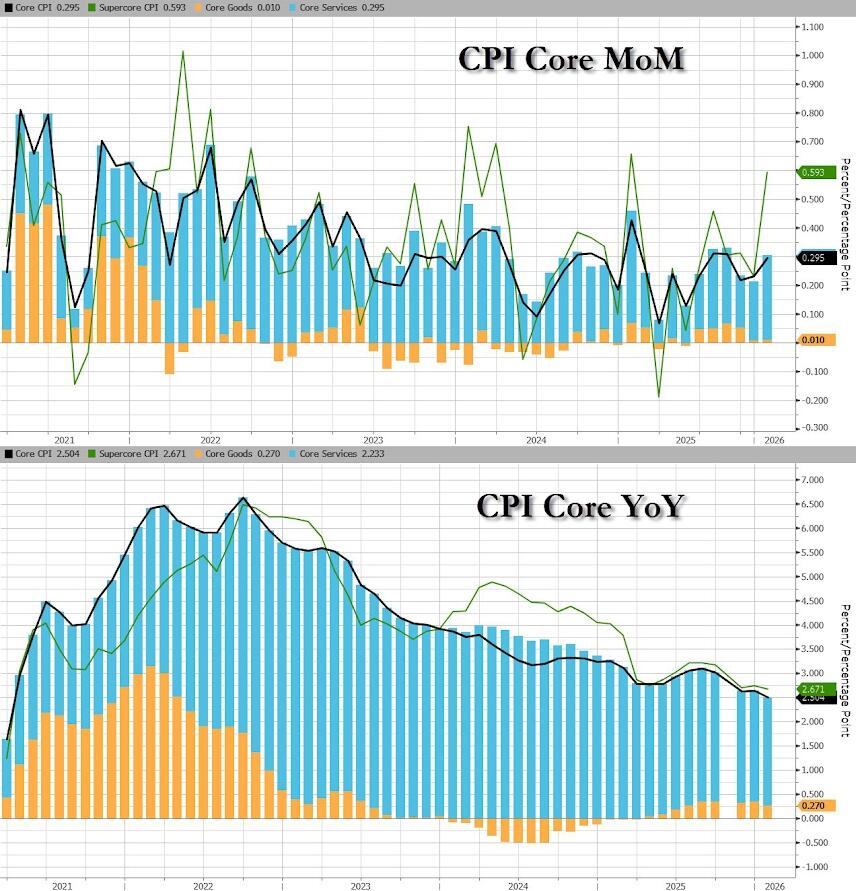

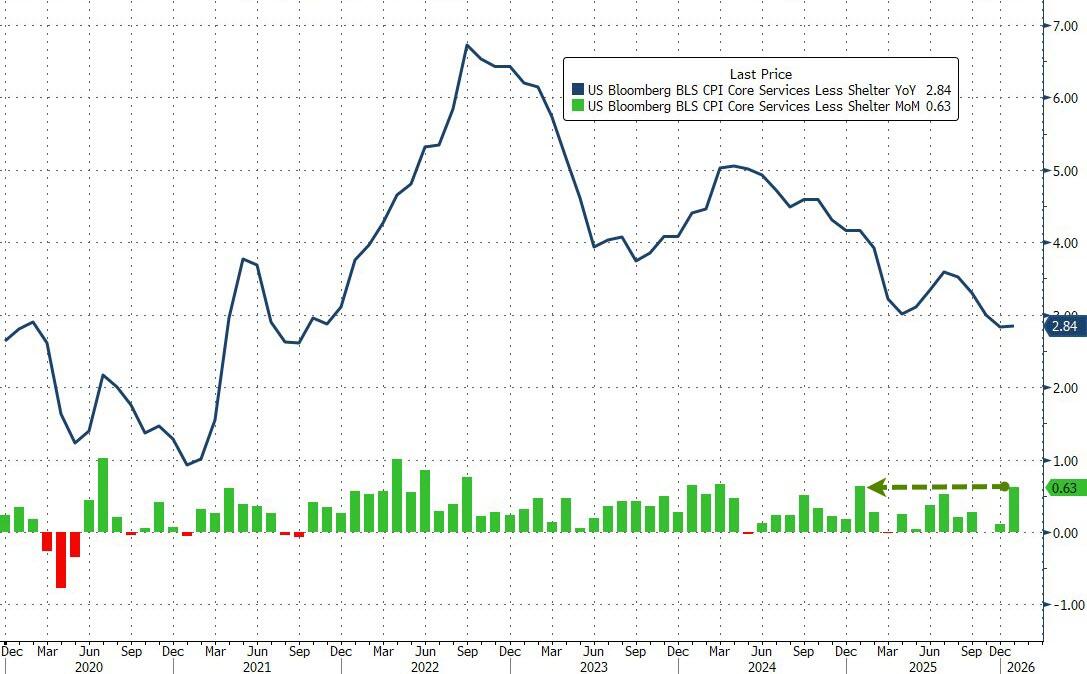

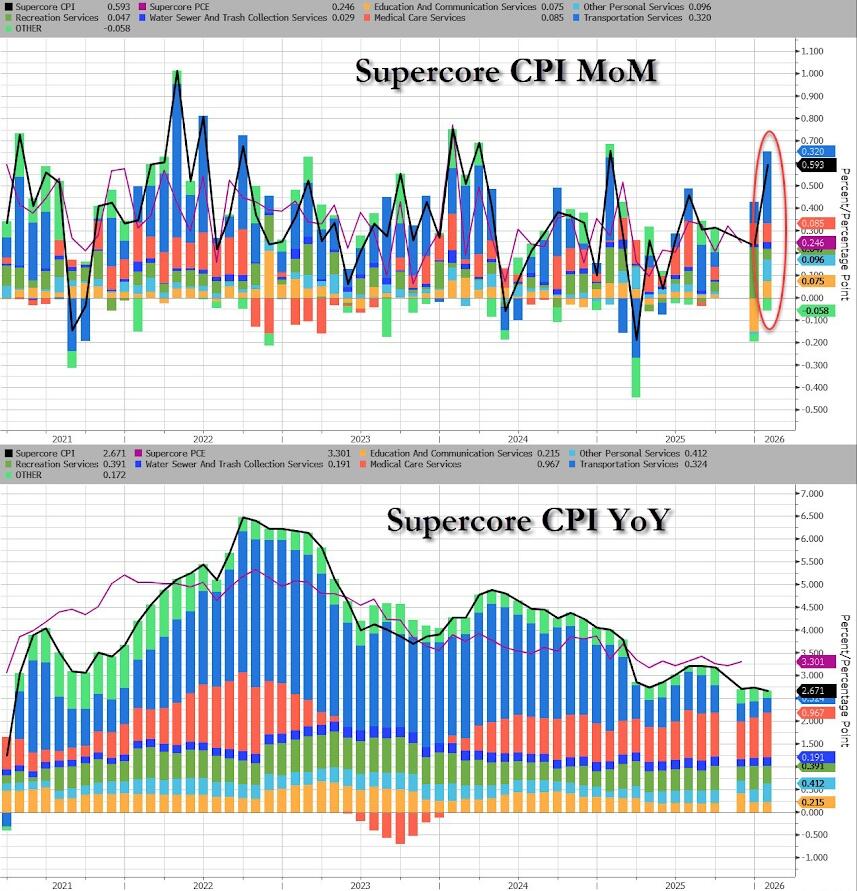

The much-watched SuperCore CPI (Services Ex-Shelter) rose notably (+0.6% MoM) but the YoY figure remains at its lowest since Sept 2021...

Driven by a big jump in Transportation and Education costs...

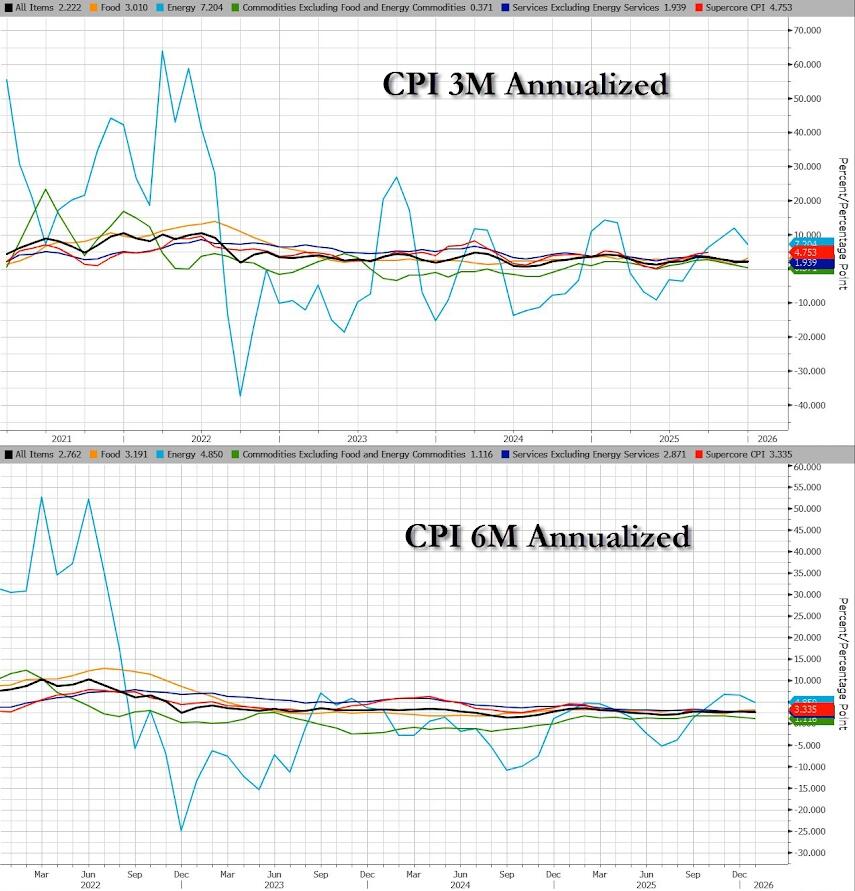

On a shorter-term basis, inflation is slowing - plain and simple...

For now, we seem to be avoiding a 1970s redux in Fed policy error helping to re-ignite an inflationary rebound...

Source: Bloomberg

...but time will tell ('run it hot').

On the other side of the ledger, January saw real average weekly earnings rise 1.9% YoY - its highest since March 2021...

Finally, according to JPM's CPI market reaction matrix (based on what the core CPI MoM prints), we should expect a solid up day for stocks:

Core MoM prints above 0.45%. SPX loses 1.25% - 2.5%: odds 5.0%

Core MoM prints between 0.40% - 0.45%. SPX gains 0.25% to loses 75bps; odds 25.0%

Core MoM prints between 0.35% - 0.40%. SPX gains 0.25% to 0.75%; odds 42.5%

Core MoM prints between 0.30% - 0.35%. SPX gains 1% - 1.5%; odds 22.5%

Core MoM prints below 0.30%. SPX gains 1.25% - 1.75%; odds 5.0%

For now, what we do know is that the mnainstream media's constant fearmongering over Trump Tariff-flation was yet another canard crushing the PhDs' credibility even further.

https://www.zerohedge.com/personal-finance/us-core-cpi-tumbles-slowest-4-years

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.